SandRidge Energy Inc. said Tuesday it will delay filing its 3Q2014 report until it has resolved a “routine review” by the U.S. Securities and Exchange Commission (SEC), which could result in restating almost two years of earnings results.

Financial

Articles from Financial

GE Energy and Vess Oil Partnering Again in Texas

GE Energy Financial Services and an affiliate of Vess Oil Corp. are buying about 13,000 net acres in East Texas and associated production from the Woodbine formation from an EnerVest Ltd. affiliate for $108 million.

Energy Firms to Fed: Don’t Exclude Banks from Commodities Markets

“If counterparties, such as banks…begin to disappear, our ability to manage our risk would be seriously impeded,” energy companies told Federal Reserve Chairman Ben Bernanke.

‘One-in-Three Probability’ for Weakening PG&E

The credit rating for PG&E Corp. and utility subsidiary Pacific Gas & Electric Co. face a “one-in-three probability” for weaker business and financial profiles over the coming year related to the San Bruno, CA natural gas pipeline explosion, according to Standard & Poor’s Ratings Services (S&P).

Cabot Sees More Marcellus Market Connections Coming

Thanks to the Marcellus Shale, Houston-based Cabot Oil & Gas Corp. recently completed the best quarter in its history on an operational and financial basis, said CEO Dan Dinges. The company is adding a sixth rig in the play as it anticipates multiple infrastructure projects will come online in the months ahead, increasing the ability to get its gas to markets.

Cabot Stepping On the Gas in the Marcellus

Thanks to the Marcellus Shale, Houston-based Cabot Oil & Gas Corp. recently completed the best quarter in its history on an operational and financial basis. The company is adding a sixth rig in the play as it anticipates multiple infrastructure projects to come online in the months ahead, increasing the ability to get its gas to markets.

State Dept. OKs Canadian Ethane Pipeline Link in North Dakota

The Obama administration has issued a presidential permit for the 80-mile U.S. pipeline link in North Dakota that is slated to carry ethane as part of a 430-mile international pipeline through Saskatchewan and terminating in Alberta.

Pipeline Extension Would Bring More NatGas to Yucatan Peninsula

GDF SUEZ Mexico and GE Energy Financial Services (GEFS) are partnering to extend the Mayakan pipeline in the Yucatan Peninsula, where Mexico’s state-owned electric utility, Comision Federal de Electricidad (CFE), has agreed to use 300 MMcf/d of natural gas in power plants currently using diesel and fuel oil.

Industry Briefs

Cheniere Energy Partners LP’s Sabine Pass Liquefaction LLC has engaged 17 financial institutions for credit facilities to fund the remaining debt necessary to develop and place into service the first four trains of the Sabine Pass liquefaction project. “We will amend and upsize the existing term loan A credit facility that was entered into last year for the financing of the first two trains [see Daily GPI, April 17, 2012], extending the available capacity to accommodate four liquefaction trains,” Cheniere said. Obtaining debt financing is one of the last steps to complete before proceeding with construction of trains 3 and 4.

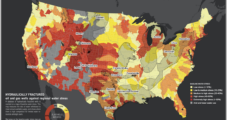

Find Fracking Solutions in ‘Water-Stressed’ U.S. Regions, Says Ceres

Energy industry efforts to reduce the amount of water used in hydraulic fracturing (fracking) through recycling and other means have to be stepped up if unconventional resources are to grow as projected, according to Ceres, which runs an influential institutional investor coalition.