The disciplined capital approach by Lower 48 natural gas and oil producers has collided with sharply higher commodity prices, giving the industry the potential to become debt free and ready to transition to lower carbon, according to Deloitte. U.S. exploration and production (E&P) companies this year alone could report a total of $1.4 trillion in…

Financial

Articles from Financial

Amid Robust Global Energy Demand, Some Banks See Enduring Natural Gas, Oil Lending Opportunities

Regional banks that lend into the oil and natural gas sector say they are increasingly active as producers borrow to invest in growth amid enduring strong demand for fossil fuels. To be sure, national banks such as JPMorgan Chase and Well Fargo & Co. have pulled back on oil and gas lending amid pressure from…

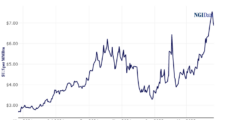

Do U.S. E&Ps Need Higher Natural Gas Prices to Offset Demand and Inflation? Yes, Says Moody’s

Natural gas development costs in the United States are rising, stung by rising consumption, inflation, supply chain issues and labor shortages, all of which are eating away at the margin, according to Moody’s Investors Service. The credit ratings agency recently hiked its medium-term Henry Hub natural gas price range by 50 cents to $2.50-$3.50/Mcf. The…

Weatherford to Pay $140M Penalty to Settle Financial Fraud Charges

Weatherford International plc, the fourth largest global oilfield services operator, agreed to pay a $140 million penalty to settle charges that it inflated earnings by using deceptive income tax accounting, the U.S. Securities and Exchange Commission said. Two former senior accounting executives settled claims that they were behind the scheme.

BP Seeks Rehearing of FERC’s $20M Decision in 2008 Market Manipulation Case

BP plc has requested a rehearing of a FERC decision last month that affirmed the findings of an administrative law judge (ALJ) and levied a $20.16 million fine against the London-based supermajor in a 2008 market manipulation case, saying it “is not the product of reasoned decisionmaking and is not supported by substantial evidence.”

Brief — Louisiana Oil & Gas Association

“Given the ongoing distress in the oil and gas industry…” Lampert Capital Markets and the Louisiana Oil & Gas Association (LOGA) have made an alliance to provide “corporate financial solutions” for the industry. “…[M]any of LOGA’s members are facing daunting financial situations,” the trade association said Wednesday. “The current environment will require LOGA members to effectively address weakened balance sheets, resolve reduced cash flows, and achieve stabilization and growth through consolidation and acquisitions. Through this partnership with LOGA, Lampert Capital will aid oil and gas industry members in developing a strategy that will help industry participants achieve their financial and investment objectives.”

BOEM Financial Assurance Rules Align With ‘Realities of Industry’ as Operators Move to Deeper Waters

U.S. offshore operators face more stringent financial assurance and risk management requirements to ensure that they can pay to decommission and remove oil and natural gas production facilities, but critics say the changes could upend the industry.

Oil & Gas Prices, Supplies, Politics Top Concerns For U.S. E&Ps, BDO Says

Volatile commodity prices, supply risks and political/regulatory developments are the top concerns of U.S. producers, and the threat of bankruptcy has reached a six-year high, according to BDO USA LLP.

SandRidge Considers Bankruptcy, Sees ‘Substantial Doubt’ to Continue as Going Concern

SandRidge Energy Inc. is evaluating options to take the company private or voluntarily reorganize under Chapter 11, the Oklahoma City-based independent said Wednesday.

Oil/Gas Downturn Squeezing Rex Energy’s Liquidity

In a series of U.S. Securities and Exchange Commission (SEC) filings made since February, Rex Energy Corp. disclosed the toll that the prolonged commodities downturn has had on the company’s financial strength.