Fitch Ratings Inc. has again downgraded the credit rating of Mexican state oil company Petróleos Mexicanos (Pemex), citing liquidity and environmental, social and governance (ESG) concerns. Pemex’s Long-Term Foreign and Local Currency Issuer Default Ratings (IDR) already were in junk territory at ‘BB-,’ and now have been lowered to ‘B+,’ the Fitch team said Friday…

Finance

Articles from Finance

PE Funding Filling Void in North America E&P as Public Operators Stay Disciplined

Private equity (PE) continues to pour into the North American oil and natural gas patch amid higher commodity prices and capital discipline by publicly traded companies. Privately held exploration and production (E&P) firm Sabalo Energy II said Wednesday it has closed a $300 million equity commitment from EnCap Investments LP. The objective “is to build,…

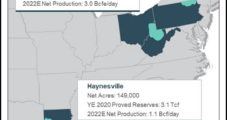

Southwestern Completes $2.7B Indigo Takeover as Haynesville Interest Heats Up

Southwestern Energy Co. has completed its $2.7 billion takeover of Haynesville Shale pure-play Indigo Natural Resources LLC. The deal completed Wednesday gives Southwestern a sizable footprint in the resurgent Louisiana play, improving the firm’s access to Gulf Coast liquefied natural gas (LNG) export markets. “This acquisition materially expands our opportunity set, adding high-margin Haynesville production…

LNG 101: Could New Ways to Sell American Natural Gas Give Rise to Second-Wave Export Projects?

U.S. liquefied natural gas (LNG) developers are going to greater lengths to attract customers, setting the stage for American supplies to increasingly be tied to foreign benchmarks and testing traditional commercial models with new agreements that could make project financing even harder to come by. The question is, why? Why would U.S. LNG buyers purchase…

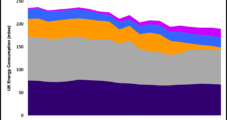

UK to End Support for Natural Gas Export, Other Foreign Fossil Fuel Projects

The UK would end government-funded financial support for overseas oil, natural gas and coal projects under a plan announced this month by Prime Minister Boris Johnson as the country continues to jockey for position in the global fight against climate change. The policy would end taxpayer support for export finance, aid funding and trade promotion…

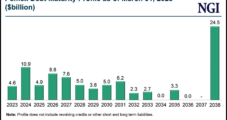

LNG 101: The Complex Process of Financing Massive LNG Projects

Total SE’s announcement last month that it had landed nearly $15 billion in funding for a Mozambique liquefied natural gas (LNG) project came as a surprise given the economic impact of Covid-19, but financing massive export terminals is a complex and lengthy affair even in the best of times. The global gas supply glut and…

PG&E Calls Proposed $2.25B Fine Excessive

Calling it dangerous and potentially harmful to its ability to finance natural gas pipeline safety upgrades, Pacific Gas and Electric Co. (PG&E) last week filed a formal reply to California regulators, strongly rejecting a safety staff recommendation of a $2.25 billion for the utility’s part in the Sept. 9, 2010 pipeline rupture and explosion in San Bruno, CA.

PG&E Fires Back at Proposed $2.25B Pipeline Fine

Calling it dangerous and potentially harmful to its ability to finance future natural gas pipeline safety upgrades, Pacific Gas and Electric Co. (PG&E) last Friday filed a formal reply to state regulators, strongly rejecting a safety staff recommendation of a $2.25 billion for PG&E’s part in the Sept. 9, 2010 pipeline rupture and explosion in San Bruno, CA.

Pennsylvania House Panel OKs Marcellus Tax Credit Bills

Lawmakers on a key committee of the Pennsylvania House of Representatives approved three “Marcellus Works” bills on Tuesday.

Top Ohio Republicans Take Aim at Severance Tax Proposal

Two prominent Ohio Republicans — state House Speaker William Batchelder (R-Media) and Treasurer Josh Mandel — told supporters of the oil and natural gas industry that they oppose Gov. John Kasich’s proposal to levy new severance taxes on hydraulic fracturing (fracking) and natural gas liquids (NGL).