Gazprom PJSC has reduced gas deliveries to France due to a disagreement over contracts, Engie SA said Tuesday.

Falling

Articles from Falling

Woodford, Bakken Steer ExxonMobil in U.S. Onshore

With production growing 39% in the Ardmore Basin’s Woodford Shale and a 75% increase in Bakken output, ExxonMobil Corp. plans to forge ahead with liquids and crude oil unconventional opportunities in North America, and keep its substantial natural gas prospects for better days, the investor relations chief said Thursday.

Industry Briefs

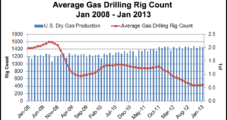

After five consecutive quarters of falling U.S. rig counts, onshore activity will improve through the rest of the year, according to a forecast by Baker Hughes Inc. There were 1,748 U.S. rigs in operation at the end of the first quarter, CFO Peter Ragauss said. “We anticipate that the rig count will rise to an average of 1,800 rigs for the second quarter. This would be the first increase in U.S. rig count following sequential declines over five consecutive quarters. And the rig count is expected to rise over the second half of the year.” Overall, “the increase from the first quarter is expected to be about 100 rigs, to a 4Q2013 average rate of approximately 1,850 rigs.” The average annual rig count this year “is projected to be 1,810 rigs, composed of approximately 1,400 oil rigs and 410 gas rigs.” The U.S. offshore rig count is forecast to be 8% higher, averaging 52 rigs with four more deepwater rigs than in 2012. The Canadian rig count in 2Q2013 is projected to decline sequentially by 70% to 160 average rigs because of the spring break-up.

U.S. Onshore Rig Activity to Rise through 2013, Says Baker Hughes

After five consecutive quarters of falling rig counts, U.S. onshore rig activity will improve through the rest of the year, according to a forecast issued on Friday by Baker Hughes Inc.

Well Freeze-Offs Muddling NatGas Production Data, Says Barclays

Determining whether Lower 48 state natural gas onshore production is falling is proving to be a difficult task because of the variable winter, but the aggregate amount of production curtailments from well freeze-offs “point to peak supply losses of as much as 1.8 Bcf/d,” according to Barclays Capital.

Northeast Points Skew Modest Market Gains; Futures Rise Again

The cash market Wednesday staged a broad rally of 15 cents with only a half-dozen points falling into the loss column as Old Man Winter refused to let go even with the first day of spring only a week away.

Northeast Leads Broad Decline, But Futures Stay In Range

Physical natural gas prices on average plunged 77 cents Monday, but free-falling prices on Northeast pipelines such as Algonquin, Iroquois and portions of Tennessee and Transco skewed the results. If those points are taken out of the mix, the decline was 10 cents. At the close of futures trading March had fallen 0.7 cent to $3.279 and April was down 0.9 cent to $3.346. March crude oil added $1.31 to $97.03/bbl.

Northeast, East Lead Broad Market Retreat; Futures Down

Cash prices tumbled an average of about a half-dollar Wednesday, led by free-falling multi-dollar drops in New England and other eastern and Northeast points. If those extra-volatile points are removed from the calculations, the overall average drop was of nearly a quarter.

BC Shales, Export Potential Forecast to Lift Canada Gas Market

Canada’s natural gas industry will see a difficult market over the next several years, marked by lower prices, falling production and a decline in exports to the United States, but unconventionals will turn around the economy once new export terminals are completed in British Columbia (BC), the Conference Board of Canada said Monday.

Storage Now At a Deficit, But Futures, Cash Tumble

Cash natural gas prices shed a dime on average Friday as steady to nominal gains at Rockies points were unable to offset falling quotes at East, Northeast and California points. Traders also cited the normal Friday reluctance to buy ahead of a weekend and weather forecasts indicated little likelihood of East and Northeast cold.