Marathon Petroleum Corp. agreed to pay $598 million plus inventories estimated at $1.2 billion for BP plc’s 451,000 b/d Texas City, TX, refinery, three instrastate natural gas liquids pipelines originating at the refinery, an allocation of BP’s Colonial Pipeline Co. shipper history, four terminals, retail marketing contract assignments for about 1,200 branded sites and a 1,040 MW cogeneration facility. The agreement contains an earnout provision under which Marathon could pay up to an additional $700 million over six years, subject to certain conditions. The acquisition is expected to be funded with cash on hand and is anticipated to close early in 2013. The deal continues BP’s plan to sell assets to shore up its share price and help fund a $20 billion trust fund set up following the April 2010 Macondo well blowout in the Gulf of Mexico (GOM) (see Daily GPI, Oct. 26, 2011). Last month Plains Exploration & Production Co. said it would pay BP $5.55 billion for deepwater GOM oil and gas properties (see Daily GPI, Sept. 11).

Estimated

Articles from Estimated

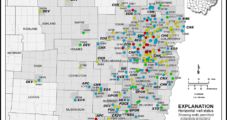

Utica Shale Emerging as Possible Triple Threat, Says IHS

It’s too early in the game to know if the productivity power of the Utica/Point Pleasant Shale in Ohio and western Pennsylvania will match other U.S. unconventional plays, but initial natural gas well data is encouraging, and if the oil-prone window is successfully derisked, the play could prove to be a triple-play hydrocarbon monster, according to IHS Inc. researchers.

Ohio Water District Authorizes Temporary Sales to Operators

The Muskingum Watershed Conservancy District (MWCD) says it will consider short-term water sales from two lakes in eastern Ohio to oil and natural gas operators drilling in the Marcellus and Utica shales.

GOM Production Nearing Pre-Isaac Levels

Based on data from offshore operator reports submitted as of 11:30 a.m. CDT Monday, the Bureau of Safety Environmental Enforcement (BSEE) estimated that about 6.11% (274.85 MMcf/d) of current natural gas production, and 7.98% (110,144 b/d) of oil output in the GOM was shut in.

Mesa Energy Building Mississippian Limestone Position

Dallas-based Mesa Energy Holdings Inc. has leased 1,525 net acres in Garfield and Major counties, OK, and has closed on a farmout agreement with Twenty/Twenty Oil & Gas Inc. covering 1,720 net acres that are held by production.

Magnum Hunter Grows Reserves, Oil/Liquids Exposure

Magnum Hunter Resources Corp. posted a 51% increase in estimated total proved reserves as of June 30 compared to the year-ago period, the shale-focused producer said.

Tenaris to Invest $1.5B to Expand U.S. Oilfield Arm

Global oilfield services operator Tenaris SA plans to invest an estimated $1.5 billion in the United States to expand onshore and offshore services, the company said Thursday.

New Sand Storage Facility Planned to Serve Eagle Ford Fracking

U.S. Silica Holdings Inc. and BNSF Railway Co. are partnering to meet the needs of Eagle Ford Shale producers for sand to be used as proppant in their hydraulic fracturing (fracking) operations.

North Dakota Again Busts Output Records, Straining Infrastructure

North Dakota continued setting new oil and natural gas production records in April, but drilling equipment shortages grew, increasing the estimated number of idle wells by 76 in April.

Analysis: Floating Production System Activity on Rise in GOM

Of the 216 projects being planned worldwide that potentially could require floating production systems, an estimated 10% are likely to be located in the Gulf of Mexico (GOM), according to an analysis conducted by Washington, DC-based International Maritime Associates Inc. (IMA).