Houston’s Hilcorp Energy Co. has completed a takeover of BP plc’s upstream portfolio in Alaska and is nearing a handoff of the midstream unit, allowing the private explorer to become one of the state’s biggest operators. The $5.6 billion deal struck last year with BP hands affiliate Hilcorp Alaska immediate control of BP Exploration (Alaska)…

E&P

Articles from E&P

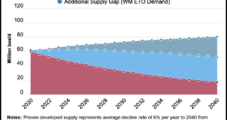

Oil, Natural Gas Exploration Said Vital to Meeting Energy Demand to 2040, Even if Global Warming Kept Under 2 C

Oil and natural gas exploration will play an essential role in meeting global energy demand through at least 2040, even if human-induced global warming is kept under 2 C, according to a new analysis by Wood Mackenzie. “Only about half the supply needed to 2040 is guaranteed from fields already onstream,” said Wood Mackenzie’s Andrew…

Pennsylvania Regulators Failed to Protect Public from Natural Gas Development Problems, Says Grand Jury

Pennsylvania Attorney General (AG) Josh Shapiro on Thursday said a two-year grand jury investigation into unconventional natural gas development uncovered “systematic failure” by regulators to protect the public from the risk of industry operations. The grand jury report recommended new state laws to better protect water supplies and manage air pollution. “This report is about…

Producer Deals for U.S. LNG Said Unlikely Amid Covid-19

The Covid-19 pandemic has made it difficult for U.S. liquefied natural gas (LNG) developers to sign additional long-term natural gas supply deals with producers to help fund new liquefaction capacity, an industry analyst said. Cheniere Energy Inc. signed two long-term deals last year with Permian Basin producers to buy natural gas at prices linked to…

Argentina Freezes Gas, Power Rates, Mulls Price Floor for Gas Production

Argentina’s government announced on Friday it is freezing natural gas prices for users until the end of the year and will forbid canceling utility services even if users haven’t paid their bills. The move is part of the country’s response to the coronavirus outbreak that has stalled the economy and has kept much of the…

RPC Cuts Workforce, Stacks Pressure Pumping Equipment as E&Ps Pull Back

Atlanta-based RPC Inc., which provides specialized oilfield services and equipment to customers working in the Lower 48 and Gulf of Mexico, has adjusted its operating strategy to compete in a “difficult environment,” CEO Richard A. Hubbell said Wednesday.

Kimmeridge Raises $800M for Fifth E&P-Focused Fund

Private equity (PE) firm Kimmeridge Energy Management Co. LLC said Wednesday it has closed its fifth upstream-focused fund after raising $800 million.

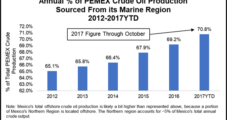

Mexico’s CNH Brings in Navy to Help Oversee Offshore E&Ps

Mexico’s upstream regulator has signed a cooperation agreement with the country’s Naval Secretariat to monitor offshore exploration and production (E&P) activities using satellite technology.

Black Hills To Sell Last of Its Oil, Natural Gas E&P Assets

Rapid City, SD-based Black Hills Corp. has decided to sell what remains of its oil/natural gas business by the end of next year, CEO David Emery reported during a 3Q2017 earnings conference call on Friday. Included are San Juan Basin and Powder River Basin assets.

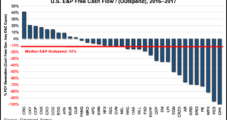

E&Ps Still Outspending Cash Flow; ’18 Budgets Likely Less Ambitious, Says Raymond James

A long-standing willingness by exploration and production (E&P) companies to outspend their cash flow may butt up against concerns about leverage and commodity uncertainty as 2018 capital spending budgets are planned, according to Raymond James & Associates.