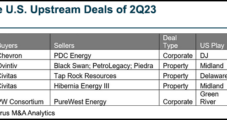

Merger and acquisition (M&A) activity in the Lower 48 upstream segment doubled year/year during the second quarter in terms of transacted value, with 20 deals totaling $24 billion, according to the latest tally by Enverus Intelligence Research (EIR). The figure was up from a comparatively sluggish $12 billion transacted during 2Q2022. Dealmaking in 2Q2023 was…

Enverus

Articles from Enverus

Natural Gas Eyed as ‘Multi-Decade’ Investment for LNG Exports, Low-Carbon Transition

Sponsoring U.S. natural gas projects will be a solid bet for years to come as overseas demand grows, and as the fuel supports the energy transition, according to private equity (PE) investors. At the Enverus Evolve conference held in mid-May, a panel of PE executives said upstream investments overall are in the money. “On the…

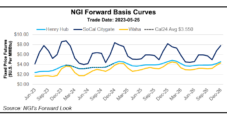

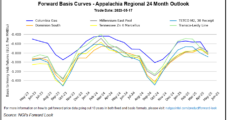

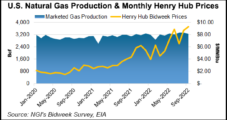

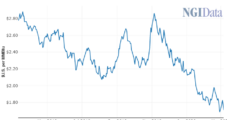

Potential Production Response Propels Natural Gas Forwards Higher

With a sharp decline in upstream activity foreshadowing a potential curtailment in domestic production, and with summer cooling demand just around the corner, natural gas forwards rallied during the May 11-17 trading period, NGI’s Forward Look data show. Week/week fixed price gains of 20 cents or more were widespread throughout the Lower 48; benchmark Henry…

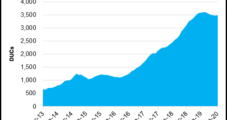

Oilfield Services Jobs Top 650,000, Reach Pandemic-Era High

Employment in the U.S. oilfield services and equipment sector (OFS) advanced in January along with an overall surge in jobs to start the new year. OFS employment rose by an estimated 3,069 jobs to 652,090 last month, according to an analysis of federal data by the Energy Workforce & Technology Council. The January increase made…

‘The Rich Get Richer’ as Large Caps Dominate Diminished M&A Market in U.S. Oil and Gas

Mergers and acquisitions (M&A) within the U.S. upstream fell to their lowest annual volume in nearly two decades last year, according to new research by Enverus Intelligence Research (EIR). Exploration and production (E&P) firms recorded 160 transactions valued at $58 billion total, the Enverus subsidiary found. This is the lowest number of deals since 2005.…

U.S. E&Ps Taking Conservative Route, Hedging Less into 2023

Natural gas hedging by North American producers was subdued during the third quarter while oil activity rose, despite the near-term bullish outlook for oil and the bearish forecast for gas, according to Enverus. Each quarter the energy data consultancy reviews North American exploration and production (E&P) hedging activity to check incremental activity, valuations and implications…

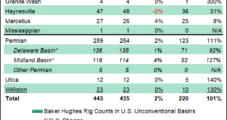

Activity Rises in Permian, Eagle Ford as U.S. Rig Count Climbs on Oil Drilling

Increased activity in the Permian Basin and Eagle Ford Shale helped push the U.S. rig count nine units higher to 512 during the week ended Friday (Sept. 17), according to the latest data from Baker Hughes Co. (BKR). A 10-rig increase in oil-directed drilling offset a one-rig decline in natural gas-directed rigs in the United…

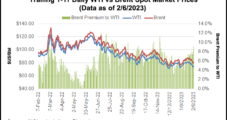

Oil Price Recovery Not Likely Until 2022; Recent Pullbacks ‘Just the Beginning,’ Says Enverus

Despite a wave of announcements by oil and gas producers to cut spending and activity in the wake of collapsing oil prices, Enverus expects to see a more significant pullback this summer as the market comes to the realization that a recovery will not come quickly.

NGI The Weekly Gas Market Report

Coronavirus Wreaks Havoc on Markets; Enverus More Optimistic on Oil Demand

An oil price war launched by the Organization of the Petroleum Exporting Countries (OPEC) and Russia battered crude oil and stocks Monday, but the long-term ramifications may not be all doom and gloom for natural gas, especially in the Permian Basin, according to analysts.

Enverus Acquires RSEG to Expand Machine Learning Solutions for Energy Industry

Austin, TX-based data analytics company Enverus has acquired upstream technology firm RS Energy Group (RSEG), a combination the partners said would help to accelerate machine learning and advanced information services for the energy industry.