Increased natural gas sales by BP plc weren’t enough to overcome mild winter-sparked decreases reported by several other big name companies, resulting in a 4% (5.86 Bcf/d) decline in gas sales transactions in 4Q2012 (135.01 Bcf/d) compared with 4Q2011 (140.87 Bcf/d)… read more

Enough

Articles from Enough

Top North American Gas Marketers (Bcf/d)

Increased natural gas sales by BP plc weren’t enough to overcome mild winter-sparked decreases reported by several other big name companies, resulting in a 4% (5.86 Bcf/d) decline in gas sales transactions in 4Q2012 (135.01 Bcf/d) compared with 4Q2011 (140.87 Bcf/d)… read more

Enterprise Advances Gulf Coast Ethane Header System

Enterprise Products Partners LP said Tuesday it has signed up enough customers to support its planned 270-mile pipeline header system to carry ethane from Mont Belvieu, TX, to petrochemical plants in the Gulf Coast region.

Marcellus Backlog May Lift Gas Output

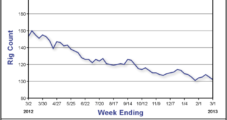

Although drilling activity in the Marcellus Shale has slowed and some producers have dropped rigs, there is enough of a drilling backlog that, if wells were brought online over a one-year period, production would continue to grow but at a slower pace, energy analysts with Barclays Capital said.

Marcellus Drilling Backlog Could Keep Production Growing in ’13

Although drilling activity in the Marcellus Shale has slowed and some producers have dropped rigs, there is enough of a drilling backlog that, if wells were brought online over a one-year period, production would continue to grow but at a slower pace, energy analysts with Barclays Capital said.

Industry Briefs

Not enough excess natural gas is available in Alaska’s Cook Inlet to support liquefied natural gas (LNG) exports to continue from the Kenai LNG Plant on the Kenai Peninsula, according to operator ConocoPhillips. The producer said it would allow the plant’s export license to expire on March 31. “For the future, ConocoPhillips will consider pursuing a new export authorization only if local gas needs are met, and there is sufficient gas for export,” the company stated. “ConocoPhillips still has the flexibility to resume operations and apply for a new export authorization if sufficient gas becomes available.” The plant was to be mothballed after selling LNG to Japan for more than 40 years, but operations were extended to meet the country’s increased demand for gas following the meltdown of the Fukushima Daiichi nuclear plant (see Daily GPI, Aug. 21, 2012). Separately, developing a large-scale LNG export facility is now a key component of Alaska’s plans to commercialize North Slope gas reserves (see Daily GPI, Dec. 12, 2012).

Rockies Strength Unable to Offset Broad Weakness; Futures Hold Gains

Physical gas prices slipped 3 cents overall on average with some strength working its way into the market, but not enough to counteract Northeast weakness.

30-Day Comment Period on Frack Rules Begins in New York

Three key lawmakers in New York say one month isn’t long enough for the state Department of Environmental Conservation (DEC) to receive public comments on proposed rules governing high-volume hydraulic fracturing (HVHF), and they are asking the agency for an extension.

Top North American Gas Marketers (Bcf/d)

Increased sales by BP plc and ConocoPhillips, along with a surge by J. Aron & Co., weren’t enough to overcome third quarter doldrums among companies selling natural gas, according to NGI’s 3Q2012 Top North American Gas Marketers Ranking. read more

EIA: August Shale Production Not Enough to Counter Overall Decline

New wells in the nation’s shale plays helped push natural gas production higher in Texas and some other states in August, but it wasn’t enough to keep the U.S. total from sliding to 76.60 Bcf/d, a 3.4% decline compared with 79.33 Bcf/d in July, according to the Energy Information Administration’s (EIA) latest Monthly Natural Gas Gross Production report.