A binding open season to test support to expand natural gas liquids (NGL) takeaway on the Texas Express Pipeline from the Denver-Julesburg (DJ) Basin to the Gulf Coast, is launching Friday, according to the sponsors.

Enbridge

Articles from Enbridge

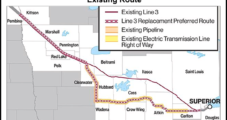

Enbridge Continues Push to Reroute Canadian Oil Export Pipeline in Minnesota

Enbridge Inc. has vowed to try again for state approval of a partial new route across Minnesota for the proposed replacement of its half century-old Line 3 oil export pipeline that runs from Alberta to the Midwest.

Minnesota ALJ Recommends Approving Controversial Enbridge Line 3 from Canada

Beleaguered Canadian exporters won a verdict Monday that favors new pipeline construction across Minnesota, as long as sponsor Enbridge Inc. confines the work to replacing a half-century-old conduit inside its original route.

Enbridge Oil Pipeline Replacement in Minnesota Draws Pushback

The Minnesota Department of Commerce has recommended the state shut down and not approve a pending oil pipeline replacement project by Enbridge Inc.

Texas Eastern’s Bayway Lateral Wins FERC Approval

Five months to the day after losing its quorum, FERC on Monday issued a certificate of approval for Texas Eastern Transmission LP’s proposed Bayway Lateral Project, which would fuel a refinery and an adjacent co-generation plant in New Jersey.

Deepwater Port License Granted For GOM LNG Export Terminal

The U.S. Department of Transportation’s Maritime Administration (MARAD) recently issued a deepwater port license for what is expected to be the first offshore floating natural gas liquefaction project in the United States.

Enbridge Cutting Workforce in Realignment After Spectra Acquisition

Calgary-based Enbridge Inc. said Wednesday it would take “the difficult but necessary step” to eliminate 1,000 jobs company-wide in order to reduce the duplicative positions that emerged after it acquired Houston-based Spectra Energy Corp.

Enbridge-Spectra Merger Done; FTC Agreement Settled GOM Concerns

Calgary-based Enbridge Inc. has completed its acquisition of Houston-based Spectra Energy Corp. in a stock-for-stock deal.

Brief — Enbridge-Spectra Energy

The U.S. Federal Trade Commission (FTC) hascleared thecombination of Enbridge Inc. and Spectra Energy Corp. FTC voted to accept a proposed consent decree in which Enbridge and Spectra have agreed to enact firewalls governing the flow of certain information to Enbridge about the Discovery offshore Gulf of Mexico natural gas pipeline system, and to take other steps limiting Enbridge’s potential influence over actions related to Discovery. Spectra holds an ownership interest in Discovery through its indirect ownership interest in DCP Midstream LP, which holds a 40% ownership interest in Discovery. Enbridge, through an affiliate, also has offshore natural gas gathering operations in the Gulf of Mexico. With FTC clearance, the merger has only one more regulatory hurdle, which is clearance under the Canadian Competition Act. The companies continue to expect the transaction to close during the first quarter.

Briefs — Enbridge-Spectra Energy

Shareholders of Spectra Energy Corp. and Enbridge Inc. have voted to approve thecombination of Spectra with Enbridge Inc. in a stock-for-stock transaction. Of the common shares of Enbridge voted at a special shareholders meeting, 99.42% were voted in favor of the issuance of Enbridge shares as consideration for the transaction, and 99.80% of the Enbridge shares were voted in favor of proposed amendments to general bylaw No. 1 of Enbridge. More than 661 million, or about 70.5%, of outstanding Enbridge shares, were voted in person or by proxy at the meeting. About 73% of the total outstanding shares of Spectra common stock, and about 98% of the total shares voted at a special shareholders meeting, were voted in favor of the transaction. The combination will create the largest energy infrastructure company in North America and one of the largest globally, with a pro-forma enterprise value of about C$165 billion (US$127 billion), Spectra said. Completion of the transaction remains subject to other customary closing conditions. Closing is expected during the first quarter.