Pioneer Natural Resources Co. will accelerate disbursing a variable dividend for shareholders amid a bullish commodity cycle and improved efficiencies across its one million acre-plus footprint in the Permian Basin, management said this week. “We are witnessing strong oil demand growth as the global macroeconomic environment continues to improve, with a corresponding improvement in commodity…

Dividend

Articles from Dividend

NGI The Weekly Gas Market Report

Williams Cuts Dividend, Counting on NatGas Demand-Driven Growth

Williams cut its quarterly dividend to 20 cents from 64 cents and outlined plans to strengthen its balance sheet and credit profile as it builds out large-scale infrastructure to capitalize on growing demand for natural gas.

BP Shareholders Reject Dudley’s Pay Raise; Chairman Says, ‘We Hear You’

BP plc shareholders staged a rare protest at the usually sedate annual meeting in London Thursday, roundly rejecting a decision to increase CEO Bob Dudley’s 2015 compensation by 20%, despite massive job cuts and record losses.

BP Shareholders Reject Dudley’s Pay Raise; Chairman Says, ‘We Hear You’

BP plc shareholders staged a rare protest at the usually sedate annual meeting in London Thursday, roundly rejecting a decision to increase CEO Bob Dudley’s 2015 compensation by 20%, despite massive job cuts and record losses.

NOV Expecting 1Q Revenue to Slump 20% Sequentially

National Oilwell Varco Inc. (NOV) expects first quarter revenues to be down 20% sequentially as market conditions continued to deteriorate from the fourth quarter. The company also reduced its quarterly dividend to 5 cents/share.

NOV Expecting 1Q Revenue to Slump 20% Sequentially

National Oilwell Varco Inc. (NOV) expects first quarter revenues to be down 20% sequentially as market conditions continued to deteriorate from the fourth quarter. The company also reduced its quarterly dividend to 5 cents/share.

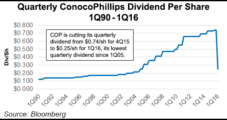

ConocoPhillips’ Rare Dividend Cut Confirms Commodity Prices Bad, Could Linger

In a sign of just how grim the commodity price environment has become — and how long it’s expected to last — ConocoPhillips cut its quarterly dividend for the first time in at least 25 years on Thursday, while also dropping 10 rigs and slashing capital expenditures (capex) for 2016 as it looks to maintain its balance sheet without racking up additional debt.

Noble Energy Slices 2016 Capex Plan by Half

Noble Energy Inc. has begun this year with a capital spending budget of $1.5 billion, about half of its planned spending in 2015, the Houston independent said Tuesday.

Briefs — WPX, Chesapeake Energy, Carbo

Tulsa’s WPX Energy Inc. has added more natural gas and oil hedges to protect cash flows through 2017. About two-thirds of anticipated gas production in 2016 is hedged at $3.63/MMBtu. Close to 75% of its expected 2016 oil volumes, 29,380 b/d, are hedged at $60.85/bbl, including 2,000 b/d added since the end of September. For 2017, WPX has hedged 92,500 MMBtu of gas at $3.22 and 9,304 b/d of oil at $61.66. The onshore operator also has reduced its long-term debt by about 17% by repurchasing $68 million in notes of a $400 million maturity due in early 2017. The next debt maturity is in 2020. WPX said it “remains engaged in discussions with third parties” to sell its San Juan Basin gathering system and all or a portion of its Piceance Basin assets. The operator is scheduled to deliver its quarterly results on Feb. 25.

NGI The Weekly Gas Market Report

Analysts Praise KMI’s 75% Dividend Cut; Investors Buy In

Kinder Morgan Inc.’s (KMI) dividend cut after market close Tuesday lifted shares in Wednesday’s trading. Some analysts and investors were relieved that KMI would retain its investment-grade credit rating and not be accessing unattractive equity markets to fund growth.