Devon Energy Corp. has a bundle of opportunities from which to choose when it allocates its capital in the Lower 48, but it has always come down to the price of natural gas and oil, a top executive said this week. COO Clay Gaspar, speaking with analysts during the first quarter 2023 conference call, explained…

Tag / Devon Energy

SubscribeDevon Energy

Articles from Devon Energy

U.S. Oil, Natural Gas M&A Slows in 2022 as Megadeals Dominate

Mergers and acquisitions (M&A) within the U.S. upstream fell to their lowest annual volume in nearly two decades last year, according to new research by Enverus Intelligence Research (EIR). Exploration and production (E&P) firms recorded 160 transactions valued at $58 billion total, the Enverus subsidiary found. This is the lowest number of deals since 2005.…

Devon Retrains Natural Gas Legacy on Europe, with Eye on LNG Investments

Devon Energy Corp., known as a sizable Lower 48 independent, is considering an LNG offtake agreement and investment stake intended to send natural gas volumes to Europe in a move management says is more about the firm’s DNA than the market of the moment. Oklahoma City-based Devon, one of the largest U.S. natural gas and…

Devon Considering Stake in Delfin, Tentative LNG Offtake Deal

Delfin Midstream Inc. has landed another potential offtaker for its Gulf Coast LNG project with Devon Energy Corp., as the Permian Basin-weighted independent seeks international exposure for its Lower 48 natural gas. Devon could have up to 2 million metric tons/year of offtake capacity and an undisclosed future stake in Delfin under a tentative heads…

Devon Bolting On Eagle Ford Oil, Gas Opportunities with $1.8B Validus Takeover

Lower 48 giant Devon Energy Corp. is becoming even larger after agreeing to buy Eagle Ford Shale pure-play Validus Energy for $1.8 billion. The transaction, set for completion by the end of September, would add 42,000 net acres that are adjacent to Devon’s existing leasehold in South Texas. Validus today is producing 35,000 boe/d, 70%…

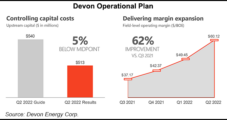

Devon Raises Natural Gas, Oil Production Forecast, with Capex Ticking Up on Inflation

On the back of strong performance in the Permian Basin, Devon Energy Corp. reported higher natural gas and oil production during the second quarter, with efficiencies helping to hold the line on costs. “The second quarter saw our business continue to strengthen and build momentum as we delivered systematic execution across the financial, operational and…

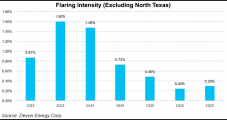

Devon Paring Flared Gas, Freshwater Use in Permian Completions to Reach Net-Zero Carbon Goals

Oklahoma City-based Devon Energy Corp. on Monday joined many of its Lower 48 oil and gas peers in establishing environmental performance targets to reduce the carbon intensity of its operations and cut overall emissions from its supply chain. By 2030 the onshore producer plans to reduce methane emissions intensity by 65%. Flaring intensity is set…

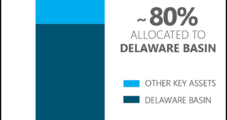

Devon All In on Permian Delaware, with Most Capital, Rigs Set for New Mexico, Texas

The Permian Basin will be the go-to target for Devon Energy Corp. this year, with 80% of this year’s capital budget and nearly all of the rigs directed to the massive formation. The Oklahoma City-based independent issued its legacy fourth quarter and full-year results last week. Results from WPX Energy Inc., which completed its merger…