Marathon Petroleum Corp. continues to evaluate converting its Kenai LNG export terminal in Alaska to import the super-chilled fuel, a project the company said ultimately could be larger than originally planned to help meet local natural gas demand. FERC approved a Marathon subsidiary’s request in 2020 to convert the Kenai terminal, which hasn’t exported any…

Decline

Articles from Decline

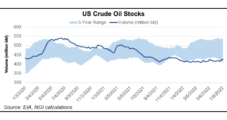

U.S. Oil Production Ebbs, IEA Cuts Global Demand Forecast as Biden Heads to Middle East

On a day when President Biden launched a Middle East tour in part to press for greater crude output, U.S. officials said American oil production declined along with consumption. A global energy watchdog also lowered its demand outlook, citing the specter of recession. One week after reaching a 2020 high, U.S. producers pumped 12.0 million…

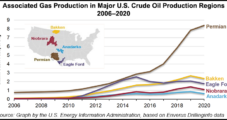

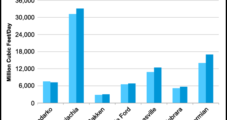

U.S. Onshore Associated Natural Gas Output Recorded First Decline in 2020 Since 2016

Associated natural gas production from U.S. onshore oil plays fell in 2020, marking the first year/year decline in output since 2016, the Energy Information Administration (EIA) said in a research note published Monday. Production of associated gas from the Permian and Anadarko basins, as well as from the Bakken, Eagle Ford and Niobrara shales, fell…

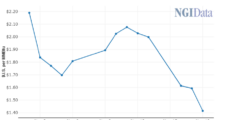

Natural Gas Forward Prices Plummet Despite ‘Resolutely Bullish’ Core Fundamentals

A balmy weather outlook that was seen potentially extending through the first third of December weighed heavily on natural gas market sentiment during the Nov. 12-18 period, sending forward prices crashing down by an average of 36.0 cents, according to NGI’s Forward Look. Similar to the prior week, the steepest losses occurred in Appalachia. However,…

North America’s Associated Natural Gas Recovery Not Seen Before 2022

Covid-19 has upended oil and gas markets across the globe, but North America is expected to account for roughly half of the decline in global associated natural gas output this year, with a slow recovery not forecast until 2022. According to projections by Rystad Energy, led by researcher Carlos Torres Diaz, head of Gas &…

Optimism Waning for Steady LNG Demand Recovery, Poten Says

The chances for a sustained recovery in global natural gas demand are being threatened by economies that have been slow to start back up as countries inch out of lockdown and face a resurgence of Covid-19 cases in some parts of the world, according to shipbroker Poten & Partners. Industrial demand remains weak in key…

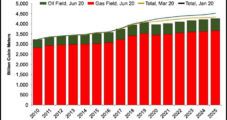

Low U.S. LNG Export Capacity Utilization Seen Continuing Through August

After soaring to record levels in March, natural gas deliveries to U.S. export facilities plummeted by more than half only two months later as Covid-19 amplified demand destruction resulting from a mild winter, according to the Energy Information Administration (EIA). The EIA said feed gas deliveries to liquefied natural gas (LNG) production terminals fell to…

LNG Recap: U.S. Feed Gas Deliveries Rebound, but More Cargo Cancellations Likely

Feed gas deliveries to U.S. liquefied natural gas (LNG) export terminals finally jumped back up on Monday after sitting below 4 Bcf/d for nearly two weeks. For the evening cycle for Monday’s gas day, Genscape Inc. estimates showed a 550 MMcf day/day jump in feed gas demand to more than 4 Bcf/d overall. “Most notably,…

Lower 48 Fracking Operations Reportedly to Hit Low Point in April, with Permian Taking Biggest Hit

The historic slump in oil drilling is likely to result in the largest monthly decline in completions activity ever recorded in the United States, according to an analysis by Rystad Energy.

NGI The Weekly Gas Market Report

Rare Natural Gas Production Decrease From Key U.S. Unconventional Plays in March, Says EIA

For the first time in three years, the Energy Information Administration (EIA) is predicting a month-to-month decline in total natural gas production from seven of the most prolific onshore U.S. unconventional plays in March, and oil production is expected to remain virtually flat.