Some Permian Basin-focused exploration and production (E&P) executive teams – Callon Petroleum Co., HighPeak Energy Inc. and Permian Resources Corp. to name a few – are reporting that oilfield services (OFS) and material prices softened during the second quarter. Houston-based Callon Petroleum Co. CEO Joe Gatto said OFS equipment prices dropped slightly. Gatto hosted a…

Costs

Articles from Costs

Gulf Coast LNG Exporters Say Nitrogen from Permian Feed Gas Challenges Industry

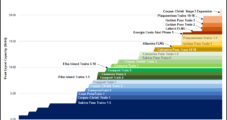

Major U.S. LNG exporters and project developers on the Gulf Coast are exploring how to tackle the costly problem of rising nitrogen and heavy hydrocarbon levels from Permian Basin feed gas. During a panel discussion at the LNG Export Engineering and Construction Conference in Houston last week, management from Freeport LNG Development LP, Sempra Infrastructure,…

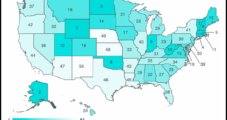

Hawaii Paying Most in U.S. for Natural Gas in 2022, Says WalletHub

At $158/month, Hawaii residents pay more for natural gas than any other state on average, while natural gas is the least expensive for New Mexico residents at an average monthly cost of $43/month, according to data from WalletHub. The Evolution Finance Inc. subsidiary reported in its latest study that in 2022, the average residential price…

Feeling Inflation Pinch, Permian E&Ps Targeting Further Efficiency Gains

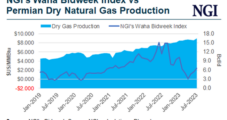

Continued efficiency improvements are expected to be critical for natural gas and oil producers in the Permian Basin this year as cost inflation for oilfield services (OFS) takes full effect.

Supply Chain ‘Snarls’ Stifle Economy, Stoke Inflation and Impede Energy Company Earnings

The worst of the pandemic’s impacts on public health may have passed, but its long shadow still hangs over the economy and the energy industry in the form of supply chain bottlenecks, labor shortages and steep inflation. Setbacks such as manufacturing disruptions in Asia and congestion at U.S. ports infuse indefinite uncertainty, energy company executives…

Coastal GasLink’s Cost, Timeline Increase on Covid Workforce Slowdowns

The Covid-19 pandemic has inflicted increased construction costs and delay on Coastal GasLink, the conduit designed to supply the Royal Dutch Shell plc-led liquefied natural gas (LNG) export project underway in British Columbia (BC), according to TC Energy Corp. “We expect project costs will increase significantly and the schedule will be delayed,” TC management said…

Global Oil Production Costs Seen Down 35% Since 2014

Breakeven costs for all unsanctioned oil projects have fallen to around $50/bbl on average, down around 10% over the last two years and 35% since 2014. With oil production less expensive to produce versus six years ago, the “clear cost savings winner” is offshore deepwater development, according to Rystad Energy’s latest assessment. Rystad’s cost of…

Tellurian Cuts Driftwood LNG Costs, Defers Haynesville Supply Pipeline

Tellurian Inc. said this week it has cut costs for the first phase of the proposed 27.6 million metric ton/year (mmty) Driftwood liquefied natural gas (LNG) export terminal as it works toward sanctioning the massive project in a weak global market. The Houston-based operator indicated in an investor presentation on Wednesday that it would achieve…

Tellurian Evaluating Options to Cut Driftwood LNG Costs

Tellurian Inc. said in a regulatory filing on Wednesday that it was evaluating options to cut the costs of the first phase of its proposed 27.6 million metric tons/year (mmty) Driftwood liquefied natural gas (LNG) terminal in Louisiana. It was the latest announcement from the company as it works to get the project off the…

NGI The Weekly Gas Market Report

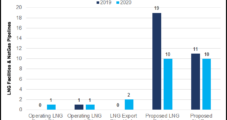

Canadian Pipeline, LNG Project Reviews Take Months Longer than in U.S., Says CERI

Complex procedures are causing pipeline and liquefied natural gas (LNG) project approvals to take more than one year longer in Canada than in the United States, inflating industry costs, according to a new economic comparison survey.