After recent years of rate decreases, Idaho regulators approved purchased gas adjustment (PGA) rate increases on Wednesday for the state’s two major natural gas utility distribution companies: Spokane, WA-based Avista Utilities and Boise, ID-based Intermountain Gas Co. The rate changes are effective Tuesday (Oct. 1).

Cost

Articles from Cost

Concho, Mexco Plying Bone Spring Together

Mexco Energy Corp. and Concho Resources Inc. have struck an agreement to develop the Bone Spring formation with horizontal drilling and multistage hydraulic fracturing (fracking).

ALJ OKs Settlement Resolving Over-Recovery of Costs by Viking Gas

A FERC administrative law judge (ALJ) has approved an uncontested settlement between Viking Gas Transmission and its shippers resolving charges that the company over-recovered costs, resulting in unjust and unreasonable rates for shippers

NW Natural Proposes Oregon CNG Service

Portland, OR-based NW Natural has asked Oregon regulators for approval to provide compressed natural gas (CNG) fueling service to business customers. The cost of the service would be paid by the individual customers using it.

NorthWestern Adds Montana Gas Reserves to Support Utility

NorthWestern Energy Corp. has increased its natural gas holdings in northern Montana’s Bear Paw Basin by acquiring some assets from Devon Energy Corp.

Quarterly Briefs

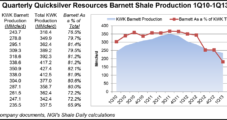

Quicksilver Resources Inc. is continuing to “hammer on the cost side” of its business, deferring elective spending in the energy patch and cutting back on staff. A recently announced joint venture (JV) in the Barnett Shale with Tokyo Gas Co. Ltd. was welcome news (see NGI, April 8), but there is more work ahead. “We are focused on the most important projects and we’re bringing in partners to both reduce debt and assist in the development of our assets,” said CEO Glenn Darden. “The company is very serious about reducing costs and living within cash flows.” Over the last year, the employee count has come down by about 20%. The Fort Worth, TX-based operator reported an adjusted net loss of $6 million (minus 4 cents/share) compared with a loss in 1Q2012 of $15 million (minus 9 cents). Since it was able to complete a long-sought Barnett Shale deal and in light of “challenging” natural gas liquids pricing, the company has shelved plans to create a Barnett master limited partnership (see NGI, Nov. 12, 2012).

Quicksilver Cutting Costs, Still Seeking Horn River JV

During the first quarter, Quicksilver Resources Inc. lost more money than Wall Street was expecting as the company continued to “hammer on the cost side” of its business, deferring elective spending in the energy patch and cutting back on staff.

SandRidge Cost Cutting Could Include Reduced Rig Count

SandRidge Energy Inc.’s revamped board of directors is making good on its promise to review the company’s strategy and costs — including a potential decrease in rig count — and allegations made against embattled CEO Tom Ward by hedge fund TPG-Axon Capital.

Chesapeake: McClendon Deals ‘Did Not Reveal Any Improper Benefit’

A lengthy review of outgoing Chesapeake Energy Corp. CEO Aubrey McClendon’s controversial financing transactions “did not reveal any improper benefit” to him “or increased cost to the company as a result of the overlap in financial relationships,” the board of directors announced Wednesday.

Economist: Pipeline Network Failing Canadian Oil Industry

If left unaddressed, pipeline shortfalls will put Canada’s oil industry at risk and will have “substantial negative impact” on the country’s economy, according to a report issued by the Canada West Foundation (CWF).