Continuing growth in the Marcellus Shale and emerging opportunities in the Utica Shale should lead to an increase in natural gas liquids (NGL) processing to 4.8 Bcf/d in 2013 from 2012’s 2.7 Bcf/d, CEO Frank Semple said last week.

Tag / Continuing

SubscribeContinuing

Articles from Continuing

Industry Briefs

The Oregon Public Utility Commission (PUC) cut rates for the three major investor-owned natural gas utilities in the state, responding to the continuing low wholesale prices for gas. The new rates take effect Thursday. Portland, OR-based NW Natural, which separately received a small general rate hike, its first in 10 years (see Daily GPI, Oct. 31), will cut its rates by 6.9%, or about $4.36/month for a typical residential customer. Spokane, WA-based Avista Utilities customers will see rates drop 7.7%, or on average about $4.78/month for residential customers. MDU Resources Group’s Kennewick, WA-based Cascade Natural Gas Corp. rates were cut 17.3%, or a decrease on average of $9.79/month for a residential customer. A purchased gas adjustment allows the PUC to have the gas utilities adjust their rates up or down annually to reflect changes in the average price of gas supplies the utilities purchase on the interstate market.

XTO, MarkWest Look to Shale’s Next Chapter

Two industry executives last week lauded the economic success brought about by shale gas development, but warned that continuing success depends in large part upon educating the public about hydraulic fracturing (fracking), training future regulators and policymakers, and being able to export liquefied natural gas (LNG).

XTO, MarkWest Execs Tout Shale Success, Push Public Interaction, LNG Exports

Two oil and natural gas industry executives lauded the economic success brought about by shale gas development, but warned that continuing success depends in large part upon educating the public on hydraulic fracturing (fracking), training future regulators and policy makers, and exporting liquefied natural gas (LNG).

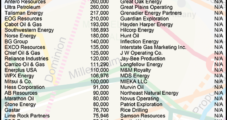

Top North American Gas Marketers (Bcf/d)

Sluggish economy and demand have gas market continuing to search for markets, analyst says. read more

Reliance on Gas for Generation Seen Growing in West

With the backdrop of high and growing reliance on natural gas for power generation driven by the continuing shale gas expansion and resulting low prices, a conference room filled with gas industry representatives Tuesday discussed ways to better coordinate regional and national gas and power grids during a daylong FERC conference in Portland, OR.

QEP Beefs Up Bakken/Three Forks Acreage in Deals Totaling $1.38B

Continuing its strategy of increasing its acreage in the liquids-rich Bakken Shale and Three Forks Formation, a QEP Resources Inc. subsidiary has entered into two deals with multiple sellers to acquire “significant crude oil development properties” in the Williston Basin for an aggregate purchase price of close to $1.38 billion.

North Dakota Economy Booming; $3.5B in Oil Tax Revenues Eyed

Driven primarily by continuing record oil production from the Bakken Shale formation, North Dakota’s economy is booming and is on target to produce more than $3.5 billion in tax revenues by the end of the state’s current two-year (2011-2013) fiscal year budget period, according to the state tax commissioner.

BP Leveled by North American Operations Losses

A write-down on U.S. natural gas resources, a decision to cancel a flagship drilling project offshore Alaska, and the continuing impact of the Macondo well blowout pummeled BP plc’s profits in the second quarter.

North American Oil Supply Growth Reveals ‘Infrastructure Mismatches’

North America’s burgeoning unconventional oil supplies have created “considerable investment needs” because pipelines are in the “wrong place carrying crude in the wrong direction and/or transporting the wrong products,” according to a review by Ernst & Young LLP.