Given current commodity prices, natural gas wells drilled in the Marcellus Shale — wet or dry — compete favorably with marginal Bakken Shale oil wells, but that’s the only gas play in the U.S. onshore that today can compete with Bakken oil well economics, according to an analysis by Barclays Capital.

Tag / Constraints

SubscribeConstraints

Articles from Constraints

California BLM Puts Lease Sales on Hold for Remainder of Year

The Bureau of Land Management (BLM) has postponed a lease sale in California that was scheduled for May 22 due to budget constraints, a shift in priorities to inspection and enforcement of existing leases, and processing of new applications for permits to drill. This was the only lease sale that the agency had proposed in the state for the remainder of the fiscal year.

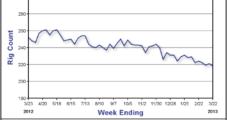

U.S. NatGas Rig Count Won’t Top 450 This Year, Says Analyst

The recent surge in natural gas prices may have provoked some optimism in the energy sector, but it’s not enough to encourage more drilling, according to Barclays Capital, which expects the rig count to not surpass 450 this year.

EIA: Pipe Constraints Creating ‘Volatile’ New England Prices

Natural gas pipeline constraints, high international prices and declining production in eastern Canada could all combine to create sometimes volatile New England gas and power prices this winter, according to the Energy Information Administration (EIA).

Algonquin, Maritimes Limit Flows Amid Cold

Cold temperatures in the Northeast have prompted constraints on Spectra Energy’s Algonquin Gas Transmission and Maritimes & Northeast (M&N) Pipeline, according to customer notices on the pipelines’ bulletin boards.

Southwestern Takes 2Q Hit from Low Gas Prices

Houston-based Fayetteville Shale pioneer Southwestern Energy Co. took a hit last quarter from low natural gas prices in the form of a large ceiling test impairment and lower operating income.

Industry Brief

Even if all drilling rigs were removed from the northern Marcellus Shale region and current drilling ceased, dry gas production in northeastern Pennsylvania would continue growing for 16 months, thanks to a large inventory of nonproducing wells and high initial production (IP) rates, Bentek Energy LLC said in a market note. “In fact, if zero rigs were operating there, production could still grow from approximately 4.1 Bcf/d today to 5.4 Bcf/d by September 2013, a 31% increase that results exclusively from working off the existing backlog of 1,000 nonproducing wells in the region,” the firm said. The assumptions in its analysis are that the 12-month average completion rate is carried forward and the average IP rate in the area is 6,500 Mcf/d. A “typical” Marcellus decline curve is also assumed. Potential pipeline capacity constraints were not included in the analysis.

Marcellus Boom Sending Rockies Gas Packing

Eastern markets used to look like the Promised Land to Rockies producers. But surging production growth from the Marcellus Shale amounts to a “keep out” sign planted along the side of Kinder Morgan Energy Partners LP’s (KMP) Rockies Express Pipeline (REX).

Marcellus and Utica Drilling Heated Up in October

Marcellus Shale drilling rebounded in October, according to recently released figures.

Indicated Shippers Protest Columbia’s Proposal to Resolve Congestion

It wasn’t the overload of Marcellus Shale supplies, but poor planning by Columbia Gas Transmission LLC that “may have created or contributed” to the storage constraints on its system in northern Ohio, Indicated Shippers said in a protest to the pipeline request for a tariff increase.