Brent crude oil prices once again are expected to reach $90/bbl-plus by the second quarter of next year amid falling global inventories, and prices for the benchmark would likely average $92 for full year 2023, according to updated modeling from the Energy Information Administration (EIA). In its latest Short-Term Energy Outlook (STEO), published Tuesday, the…

Tag / Commodities

SubscribeCommodities

Articles from Commodities

High Energy Prices Said Sustaining Russia’s Invasion of Ukraine

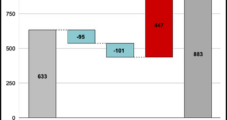

As European natural gas prices rise yet again, data suggest Russia’s gains from global energy market volatility are blunting the impact of sanctions on its exports. In a study from the Centre for Research on Energy and Clean Air (CREA), an international research group based in Finland, researchers concluded record-high energy prices are helping Russia…

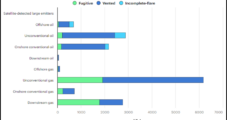

ExxonMobil, Chevron Investors Green Light Some Improved Climate Disclosures

Shareholders made demands mostly around reducing carbon emissions, but the fireworks that lit up annual meetings last year were missing for ExxonMobil and Chevron Corp. Investors overall stuck with board recommendations at the two events in late May. However, there was more support for increased climate disclosures. At the ExxonMobil annual meeting last week, 52%…

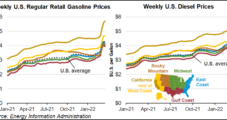

With U.S. Output Flat and War in Ukraine Stoking Fresh Global Supply Worries, Oil Prices Surge

U.S. crude production was flat last week, as it has been throughout 2022, even as the Russia-Ukraine conflict drags on and global supply worries intensify. Output for the week ended March 18 held at 11.6 million b/d, even with the prior week and a month earlier, the U.S. Energy Information Administration (EIA) said Wednesday. American…

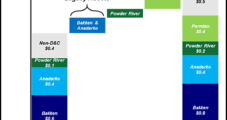

Continental Execs Tout Multi-Basin Approach, Production Restraint Amid High Oil and Gas Prices

Continental Resources Inc.’s recent expansions into the Powder River and Permian basins have given it the inventory and optionality needed to capitalize on strong oil and natural gas prices, management said. In a conference call to discuss fourth quarter and full-year 2021 earnings, CEO Bill Berry said that “as an unhedged oil producer, we were…

Supercycle Underway for Natural Gas, Oil Markets, Says Schlumberger CEO

A steady recovery in global energy demand, combined with tighter natural gas and oil supplies, are creating favorable conditions for activity in the year ahead, Schlumberger Ltd. CEO Olivier Le Peuch said Friday. The largest oilfield services (OFS) company in the world unveiled its strong fourth quarter results, with Le Peuch detailing the outlook and…

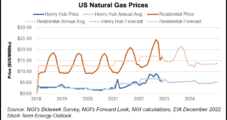

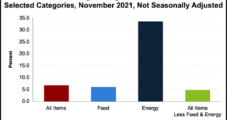

Oil, Natural Gas Prices Drive Sustained Surge in Inflation

Lofty oil and natural gas prices played outsized roles in fueling spikes in inflation this year. November proved no exception, with price increases reaching a pace last recorded nearly four decades ago. The U.S. Bureau of Labor Statistics (BLS) said Friday the consumer price index surged 6.8% in November from the same month a year…

Suncor Sees Oil Prices Jump Sharply, Commits 10% of Capital to GHG Initiatives

Calgary-based Suncor Energy Inc. saw its earnings jump in the first half of the year, as oil demand rose and the pandemic receded, resulting in the North American retail unit standing out as the growth star. Maintenance turnaround projects, which limited production and sales by the refineries and oilsands operations during 2020 and early this…

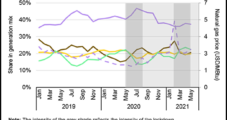

U.S. Coal Market Fundamentals Said ‘Extremely Strong’ as Natural Gas Prices Soar

The coal market is witnessing a resurgence in the United States as natural gas prices skyrocket and utilities turn to coal-powered generation, according to Alliance Resource Partners LP (ARLP) CEO Joseph Craft. “Commodity prices for each of our business segments have skyrocketed to levels not experienced in several years,” Craft said as second quarter earnings…

Trading Giant Vitol Agrees to Settle Latin American Bribery Case

The U.S. affiliate of Swiss commodities giant Vitol Inc. has admitted to bribing Brazilian, Ecuadorian and Mexican officials over the course of more than a decade in exchange for illicit competitive advantages. Vitol agreed to pay $135 million to resolve the U.S. Department of Justice’s investigation into the schemes to pay off government officials in…