The Carlyle Group LP, a global private equity firm, announced Monday that it has entered into an agreement to form a joint venture (JV) with EOG Resources Inc., and will invest up to $400 million to help the company develop its oil and natural gas assets in Oklahoma.

Cleveland

Articles from Cleveland

XTO Chief Calls Appalachian State Regulations Outdated

XTO Energy Inc. President Randy Cleveland told a Pittsburgh audience Wednesday that if the Appalachian Basin expects to remain competitive in a rapidly evolving energy market, state policies and regulations will need to adapt.

ExxonMobil Grabs More Permian Acreage, Sells Gassy Utica Property

ExxonMobil Corp.’s onshore U.S. subsidiary on Monday agreed to buy oily land in the Permian Basin of Texas and sell natural gas-weighted Utica Shale property in Ohio.

Jones Energy Adds to Anadarko Basin Assets

Jones Energy Inc. has agreed with an undisclosed private company to acquire both producing and undeveloped oil and gas assets in the Anadarko Basin for $195 million.

Industry Briefs

Plains All American Pipeline LP is constructing a 95-mile extension of its Oklahoma crude oil pipeline to service increasing production from the Granite Wash, Hogshooter and Cleveland Sands producing areas in western Oklahoma and the Texas panhandle. The new Western Oklahoma pipeline will provide up to 75,000 b/d of takeaway capacity from Reydon, OK, in Roger Mills County to PAA’s Orion station in Major County, OK. At the Orion station, crude oil will flow on PAA’s existing pipeline system to the PAA terminal in Cushing, OK. The new Western Oklahoma pipeline is supported by long-term producer commitments and is expected to be in service by the end of the first quarter of 2014, the company said.

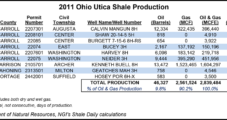

Utica Researcher: Accurate Decline Curve Data Needed

A professor at Ohio’s Cleveland State University (CSU) said permitting activity in the Utica Shale this year is in line with projections but further success in the play depends on obtaining accurate decline curve data for production over a longer period of time.

Utica Researcher: Decline Curve Data Needed for Accurate Output Forecast

A professor at Ohio’s Cleveland State University (CSU) said permitting activity in the Utica Shale this year is in line with projections but further success in the play depends on obtaining accurate decline curve data for production over a longer period of time.

Apache Pays $2.85B for Cordillera, Adds to Anadarko Properties

Apache Corp. is picking up 254,000 net acres in the Granite Wash, Tonkawa, Cleveland and Marmaton plays in Oklahoma and Texas with estimated proved reserves of 71.5 million boe through a $2.85 billion deal to acquire privately held Cordillera Energy Partners III LLC, the Houston-based company said Monday.

Industry Briefs

Cleveland-based Chart Industries Inc., a manufacturer of equipment to handle hydrocarbon and industrial gases, said it is expanding manufacturing capacity for liquefied natural gas (LNG) equipment to meet growing North American infrastructure demand. “We are expanding capacity to meet current customer needs and to remain ready to serve the rapid growth we are seeing in North America for LNG equipment for applications such as fueling stations, transportation and remote power generation,” said Tom Carey, president of Chart’s distribution and storage unit. “We believe we are in the early stages of a substantial LNG infrastructure buildout in North America that we expect will last for many years, similar to opportunities we are pursuing in China and elsewhere.” The company said its first phase of investment will be about $4 million at a site in the Upper Midwest during the fourth quarter.

EOG Holding Marcellus Leases for Long Term, Says Papa

EOG Resources Inc. has taken its Marcellus Shale leasehold off the market because it’s a “core holding” and big plans are on the table to develop it once natural gas prices recover, CEO Mark Papa said Tuesday.