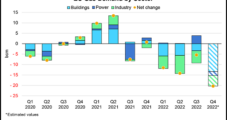

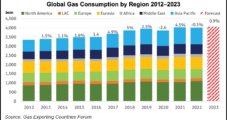

Global natural gas demand is expected to remain flat in 2023 with modest growth in the Asia-Pacific region offset by projected declines in Europe and North America, according to the International Energy Agency (IEA). The world’s natural gas consumption declined 1.5% year/year in 2022, driven largely by a sharp increase in prices after Russia invaded…

china

Articles from china

LNG Takes a Backseat in China Amid Country’s Broader Natural Gas Market Reforms – Column

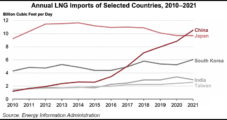

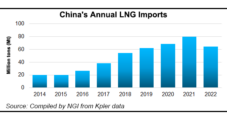

Incredible rates of growth in fuel switching and infrastructure development allowed China to go from first time LNG importer to a short stint as the world’s largest in 2021.

LNG Market Shifting Attention to Summer as Demand Remains Weak Across Asia, Europe – LNG Recap

The LNG market was again muted as the week got underway with hotter weather and restocking demand still in the offing. In Europe, the prompt Title Transfer Facility (TTF) gained just a penny in a quiet day of trading amid labor holidays across the continent. The June contract gave up 4% last week to finish…

Despite Spring Lull, Competition for LNG Could Heat Up Between Asia, Europe as Year Unfolds

Competition to secure LNG cargoes for next winter could intensify as the year progresses, but to what extent Europe and Asia face off depends heavily on a variety of factors, including plant outages, supply, demand, and of course, the weather. The global liquified natural gas market has mixed forecasts on what direction top Asian LNG…

China’s Evolving Influence on the LNG Market and What Comes Next – Column

It is easy to forget that China is a relatively new member of the LNG importers club.

China’s Sinopec Takes Equity Stake in QatarEnergy’s North Field East LNG Project

China Petroleum and Chemical Corp., aka Sinopec, has agreed to take a stake in QatarEnergy’s North Field East (NFE) LNG expansion project, the first equity deal between a Chinese state-owned firm and the major natural gas exporter. Sinopec negotiated a 5% stake in one of the four 8 million metric ton/year (mmty) capacity trains outlined…

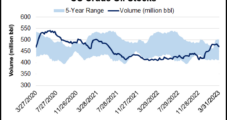

Natural Gas Market Not Ruling Out U.S. Cargo Cancellations This Summer as LNG Floods Europe

European natural gas storage inventories are so full heading into injection season and Asian demand remains weak enough that there is a remote possibility of U.S. LNG cargo cancellations later this summer. Even a limited number of cargo cancellations would mark an extraordinary turnaround from a tight market that’s been shaped by supply fears since…

North American Coal Retirements, Asian LNG Demand Drive Global Natural Gas Rebound in 2023, GECF Says

Global natural gas consumption is expected to rebound this year as easing price volatility and rising economic activity boosts LNG imports from China and South Asia and North America’s power market continues to cut coal-fired capacity, according to the Gas Exporting Countries Forum (GECF). Researchers with the organization headquartered in Qatar in the annual report…

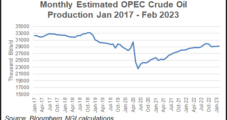

U.S. Oil Production Flattens as Saudi Arabia, Russia Cut Output

U.S. exploration and production (E&P) firms kept crude output even last week amid an uncertain demand outlook and expectations for steep cuts to global supplies. E&Ps produced 12.2 million b/d for the week ended March 31, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report (WPSR) on Wednesday. The result was flat…

Saudi Arabia, Allied Producers Announce Steep Oil Output Cuts; $110 Price Potential

Saudi Arabia said Sunday it would further scale back crude production by 500,000 b/d from May through the end of the year, leading a broader OPEC-plus effort to curb supplies and bolster prices. In total, the Saudi energy ministry said the group of producer countries would cut more than 1 million b/d. This would come…