Royal Dutch Shell plc said Monday that it was backing out of the Lake Charles liquefied natural gas (LNG) export project under development in Calcasieu Parish, LA, due to deteriorating market conditions, leaving Energy Transfer LP (ET) to move ahead on its own.

Charles

Articles from Charles

NGI The Weekly Gas Market Report

Shell to Dump Stake in Lake Charles LNG as Market Falters

Royal Dutch Shell plc said Monday that it was backing out of the Lake Charles liquefied natural gas (LNG) export project under development in Calcasieu Parish, LA, due to deteriorating market conditions, leaving Energy Transfer LP (ET) to move ahead on its own.

FERC Gives Lake Charles LNG Another Five Years to Finish Gulf Coast Export Project

FERC on Thursday granted the developers of a liquefied natural gas (LNG) terminal in Calcasieu Parish, LA, a five-year extension to build export facilities and place them in-service as the project moves toward a final investment decision.

Energy Transfer, Shell Want Five-Year Extension for Lake Charles LNG

The developers of a proposed liquefied natural gas (LNG) terminal in Lake Charles, LA, have asked federal regulators for a five-year construction extension, citing a “complex international merger” that required re-evaluating the project and negotiating project agreements.

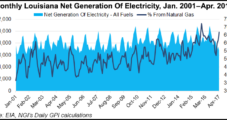

Entergy Cleared to Build Nearly $1B NatGas Power Plant in Louisiana

The Louisiana Public Service Commission this week approved construction of a 994 MW natural gas-fired power plant to serve a heavily industrialized area in the Lake Charles region where petrochemical and gas export projects are growing.

Correction

Lake Charles Methanol LLC, which is overseeing construction of a petroleum coke and carbon capture facility in Louisiana, is not related to a previous project, as reported in the story, “Lake Charles Methanol Secures DOE Backing for World’s First Carbon Capture, Petcoke Facility.” Leucadia Energy LLC in 2014 canceled a project that was to be in the same location, and all programs related to it were terminated at that time. NGI regrets the error.

Briefs — Lake Charles LNG, Vermont Gas Systems

Lake Charles LNG Export Co. LLC and Lake Charles Exports LLC have applied to the U.S. Department of Energy for authorization to export from the planned Lake Charles LNG terminal in Louisiana up to 121 Bcf/year to countries with and without free trade agreements with the United States. The companies are currently authorized to export 730 Bcf/year from the terminal. The additional authorization sought is intended to align the total authorized export volume with the planned production capacity of the terminal as approved by the Federal Energy Regulatory Commission (see Daily GPI, Dec. 17, 2015).

NGI The Weekly Gas Market Report

Shell Profits Slump 93%; Lake Charles LNG Project Shelved

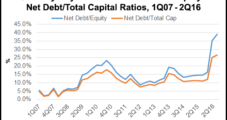

Royal Dutch Shell plc’s second quarter profits plunged from a year ago to their lowest level in 11 years, slammed by lower commodity prices, weak refining margins and stumbling production. And the outlook for liquefied natural gas (LNG), considered a primary motivation to merge with BG Group plc, is so poor that the Lake Charles, LA export project has been tabled — the second North American project canned this month.

Briefs — BP, Jordan Cove Resolution, St. Charles Transportation Project

The U.S. Supreme Court has rejected a request by shareholders of BP plc to revive a class action lawsuit that asserted the oil major misrepresented safety procedures before the Macondo blowout in April 2010(Ludlow, et al. v BP plc, et al., No. 15-952). The high court affirmed a September 2015 decision by the U.S. Court Appeals for the Fifth Circuit in New Orleans, which refused to certify a petition filed by investors that bought shares up to 2.5 years before the tragic incident. BP had argued that the lawsuit should not proceed because the plaintiffs improperly were seeking damages for the entire decline in the share price as a result of the incident. The appeals court said some investors might have bought stock knowing the risks, and ruled that investors could sue BP individually. The appeals court also in the ruling allowed a lawsuit by investors to move forward concerning shares that were bought after the incident.

Briefs — BP, Jordan Cove Resolution, St. Charles Transportation Project

The U.S. Supreme Court has rejected a request by shareholders of BP plc to revive a class action lawsuit that asserted the oil major misrepresented safety procedures before the Macondo blowout in April 2010(Ludlow, et al. v BP plc, et al., No. 15-952). The high court affirmed a September 2015 decision by the U.S. Court Appeals for the Fifth Circuit in New Orleans, which refused to certify a petition filed by investors that bought shares up to 2.5 years before the tragic incident. BP had argued that the lawsuit should not proceed because the plaintiffs improperly were seeking damages for the entire decline in the share price as a result of the incident. The appeals court said some investors might have bought stock knowing the risks, and ruled that investors could sue BP individually. The appeals court also in the ruling allowed a lawsuit by investors to move forward concerning shares that were bought after the incident.