Exco Resources Inc. is paying Chesapeake Energy Corp. $1 billion for something wet and something dry: about 55,000 acres in the liquids-rich Eagle Ford Shale of Texas and about 9,600 acres in the drier Haynesville Shale in North Louisiana.

Certain

Articles from Certain

Pennsylvania Supreme Court Reaffirms Property Rights

The Pennsylvania Supreme Court reaffirmed the state’s 131-year history of mineral rights law on Wednesday, unanimously ruling in favor of a Susquehanna County couple that had filed suit over the rights to the Marcellus Shale gas under their property.

Resolute Rethinks Permian Plan, Production Outlook

Resolute Energy Corp. said Friday it plans to run with the Wolfcamp pack this year and increase net production by more than 50% over the 2012 level, reflecting, in part, recent acquisitions in Midland and Ector counties, TX.

Kinder Putting More Straws in Texas Shales with Copano Deal

With its acquisition of Copano Energy LLC, announced Wednesday, Kinder Morgan Energy Partners LP (KMP) will expand its footprint in Texas shale plays, the Eagle Ford in particular, as it adds gas gathering, processing, treating and natural gas liquids fractionation assets.

EQT Hits Record Sales Volumes Overall and in Marcellus

EQT Corp. announced Thursday that horizontal drilling in the Marcellus Shale helped the company achieve record sales volumes overall and in the Marcellus in 2012 — the latter an 85% increase from 2011 — as it posted net income of $183.4 million for the year.

Transco Seeks FERC Approval to Start Up Mid-Atlantic Connector

Transcontinental Gas Pipe Line (Transco) has asked FERC for the go-ahead to place certain of its Mid-Atlantic Connector expansion facilities into service by the end of the month.

Ultra Sells Wyoming Liquids Pipe, Gathering Assets for $225M

Ultra Petroleum Inc.’s Wyoming unit on Friday agreed to sell a liquids pipeline system and gathering facilities and certain associated real property rights in the Pinedale Anticline in Wyoming for $225 million. The buyer is Pinedale Corridor LP, a newly created unit of CorEnergy Infrastructure Trust, and the deal is expected to close later this month.

CFTC Sets April Compliance Deadline for Swap Reporting

The Commodity Futures Trading Commission (CFTC) has established a new April deadline for swap dealers to comply with certain reporting requirements under the Dodd-Frank Wall Street Reform Act.

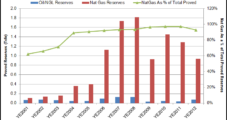

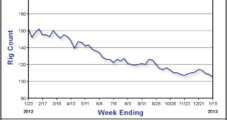

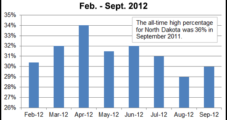

North Dakota Sets More Production Records

North Dakota continues to set new records for oil and natural gas production, but it also continues to see more flared gas, according to officials.

Warren Completes Anadarko Atlantic Rim Project Asset Acquisition

Warren Resources Inc. reported Monday that it has closed on its previously announced deal to acquire certain additional natural gas and midstream assets from subsidiaries of Anadarko Petroleum Corp. in the Atlantic Rim Project area in Wyoming’s Washakie Basin. After learning this past summer that Anadarko was soliciting bids for all of its operated coalbed methane (CBM) assets in the Atlantic Rim Project (see Daily GPI, Aug. 9), Warren, which was a working partner with Anadarko on a number of the assets, decided to exercise its preferential rights to purchase Anadarko’s share.