ExxonMobil is boosting its capital investments over the next five years around the world, prioritizing the Permian Basin, Brazil, Guyana and LNG, with a “sizable increase” in lower-emissions initiatives, executives said Thursday. The corporate plan through 2027 would hold annual capital expenditures (capex) at $20-25 billion, while growing lower-emissions investments by nearly 15% to $17…

Tag / Capital Spending

SubscribeCapital Spending

Articles from Capital Spending

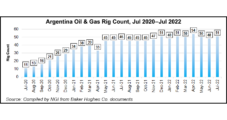

Argentina’s YPF Upping Capital Budget to $4B, Driven by Vaca Muerta Shale

Argentine national oil company YPF SA has raised its capital expenditure (capex) forecast for full-year 2022, with a focus on developing the Vaca Muerta Shale formation. New CEO Pablo Iuliano and CFO Alejandro Lew hosted a conference call to discuss the 51% state-owned company’s second-quarter results. “Better-than-expected economic performance so far in 2022 enhanced our…

CNX Increases Spending to Stay Ahead of Inflation

CNX Resources Corp. will increase this year’s capital expenditures (capex) as it battles through inflationary pressures and works to keep its operations stable heading into next year. The Appalachian pure-play is now guiding for a 2022 capex range of $550-590 million, up $70 million at the midpoint from its previous forecast. “We are planning to…

U.S. E&P Capex Said Roaring Higher as Upstream Fundamentals Strengthen

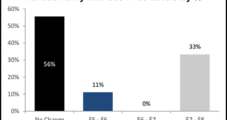

Global oil and natural gas upstream spending is climbing sharply higher from initial 2022 forecasts, with North America likely looking at a 33% jump from last year. Evercore ISI last December in its global upstream capital expenditure (capex) survey, said the average increase over 2021 would be 16%. However, exploration and production (E&P) companies worldwide…

Are Stock Buybacks the Wisest Choice for U.S. E&Ps?

Large stock buyback plans have been popular among public exploration and production (E&P) companies with strong free cash flow (FCF), but informed industry-watchers offered mixed views on whether they are the best option for companies at this time. NGI’s Patrick Rau, director of strategy and research, ticked off a list of share repurchase advantages. Buybacks…

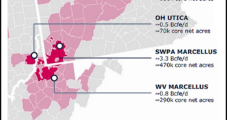

EQT Developing ‘Next Generation’ of Unconventional Wells in Appalachia

EQT Corp. now expects the Mountain Valley Pipeline (MVP) to come online in 2023, which could help narrow its natural gas price differentials and ease Appalachian takeaway constraints, but management acknowledged last week that the “specter of timing” continues to loom over the project. EQT has capacity booked on the system and a stake in…

PG&E Bets Big on Infrastructure Projects to Move Utility into ‘New Era’

Pacific Gas and Electric Co. (PG&E), riding on the momentum of a positive fourth quarter of 2021 and shrinking annual losses, has shifted focus to ambitious projects it hopes will reduce risks of wildfire events that have plagued the company. In what CEO Patti Poppe called a “new era” for PG&E during a Thursday 4Q2021…

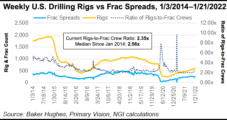

Halliburton Eyeing ‘Strong Year’ as North America E&Ps Seen Boosting Capex by 25%

North American exploration and production (E&P) companies are set to increase their capital spending by 25% or more from 2021 as they ramp up activity to keep pace with rising global oil and gas demand, Halliburton Co. CEO Jeff Miller said Monday. The management team shared a microphone to discuss the macro environment, and discuss…

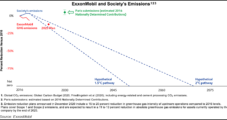

Under Pressure, ExxonMobil Ups Ante Against Global Warming, Promises to Contain Overall Costs

ExxonMobil on Tuesday pledged $3 billion to lower emissions in a bid to bolster its environmental record even as it slashed overall capital spending and vowed to safeguard its dividend. Executives, while declining to directly address a news report that ExxonMobil and fellow supermajor Chevron Corp. had discussed a potential tie-up, also said they continue…

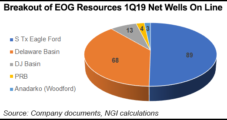

EOG Holds Firm on Capital Spending, Reports 17% Increase in Production

With oil prices on the rebound, onshore heavyweight EOG Resources Inc. is holding firm on capital spending while it increases oil export capacity from the U.S. Gulf Coast, as overall production increased more than 17%.