U.S. shale oil breakevens have fallen by $20/bbl in one year and may decline more on field efficiencies, resulting in a duel with OPEC for market share…

Capex

Articles from Capex

U.S. Shale Oil, OPEC Fighting for Market Share, Says Goldman

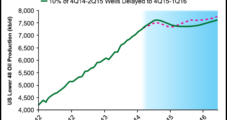

U.S. shale oil breakevens have fallen by $20/bbl in one year and may decline more on field efficiencies, resulting in a duel with OPEC for market share, while the rest of the industry fights for relevance, according to Goldman Sachs.

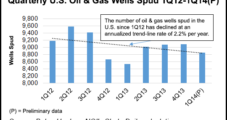

U.S. Upstream Capex Curtailments Twice Global Average, Says Raymond James

Global upstream spending began to peak last year before the oil price meltdown, but the sharp cuts in capital expenditures (capex) for 2015 have moved into a league of their own, i.e. “austerity on steroids,” according to Raymond James & Associates Inc.

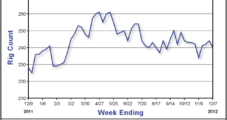

Domino Effect of Lower Oil/Gas E&P Capex Now Hitting Offshore, Midstream

Capital spending reductions by exploration firms and the pace of falling rigs have moved beyond trivial and now pose real dangers to 2015 prospects, according to analysts.

Marathon to Cut Capex by 20%, With ‘Significant Weighting’ to U.S.

Marathon Oil Corp. plans to cut 2015 spending by 20%, or about $1 billion, year/year with “significant weighting” to U.S. resource plays.

Surge in U.S. Well Completions Predicted After ‘Abnormally High Backlogs’ in 1Q2014

Global exploration and production (E&P) spending in 2014 should increase for the fifth year in a row, with the largest gains again in North America (NAM), a Barclays Capital annual survey has determined.

Rich Kinder Defends Pipe Maintenance Spending Record

Shares of Kinder Morgan Inc. (KMI) closed up more than 4% Wednesday following a pre-market conference call during which CEO Rich Kinder went through a point-by-point explanation of how the company and its Kinder Morgan Energy Partners (KMP) account for spending to maintain pipelines and other assets.

Gulfport Chalks Up More Results in Utica

Gulfport Energy Corp. Tuesday reported production results for two more Utica Shale wells and said it plans to have natural gas and liquids flowing to pipelines this spring.

Noble to Target Niobrara, Marcellus in 2013

Noble Energy Inc. plans to spend $3.9 billion on capital expenditures (capex) in 2013, almost half of which is to go toward drilling horizontal wells in the Niobrara-Denver Julesburg (DJ) Basin.

Rosetta Mystery Play to Get 10% of 2013 Spending

More than 85% of Houston-based Rosetta Resources Inc.’s 2013 capex budget of $700 million will be spent in the liquids-rich window of the Eagle Ford Shale. About 10% of spending will go to evaluation of new venture opportunities outside the Eagle Ford that the company recently began talking about.