More than half (59%) of oil and natural gas industry executives surveyed by Deloitte recently said they believe the energy industry recovery has begun or will start next year, the consultant said Wednesday.

Capex

Articles from Capex

Wood Mackenzie Says Operators Slashing Lower 48 Capex by $150B Through 2017

Oil and gas producers have slashed $150 billion from their capital expenditure (capex) budgets for the Lower 48 states through 2017, a reduction in capex that’s more than three times that spent in any single country, according to an analysis by Wood Mackenzie.

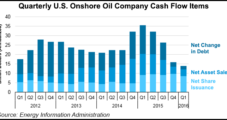

U.S. Oil Producer Capex Cuts Improving Bottom Line, Says EIA

U.S. onshore producers are far and away more stable financially today than they have been since the oil price bust, the Energy Information Administration said Monday.

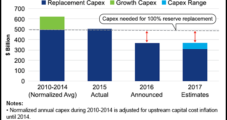

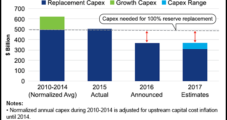

Limited E&P Cash Flows Pose Risk of Underinvestment, Deloitte Says

The global exploration and production (E&P) sector is on pace for major underinvestment through 2020, as companies use cash flows to shore up their balance sheets, according to a report released Wednesday by Deloitte LLP.

Global E&P Sector Facing $2 Trillion Funding Gap Through 2020, Deloitte Says

The global exploration and production (E&P) sector is on pace for major underinvestment through 2020, as companies use cash flows to shore up their balance sheets, according to a report released Wednesday by Deloitte LLP.

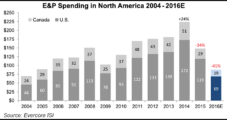

North American E&Ps to Cut 2016 Capex by 41%, with Onshore Spend Down by Half, Says Survey

North America’s oil and gas operators, more than any group worldwide, are enduring the “most extreme” capital spending cuts, with expenditures likely to drop by 41% on average from 2015 and the onshore sector seeing the most pain, according to Evercore ISI.

Vanguard Increasing Capex for Pinedale Anticline Drilling

Houston-based Vanguard Natural Resources LLC said it plans to use proceeds from the sale of some assets in the Midcontinent to pay down its debt, while it plans to bump up its capital expenditures (capex) for the remainder of the year to conduct drilling in the Green River Basin’s Pinedale Anticline.

Vanguard Increasing Capex for Pinedale Anticline Drilling

Houston-based Vanguard Natural Resources LLC said it plans to use proceeds from the sale of some assets in the Midcontinent to pay down its debt, while it plans to bump up its capital expenditures (capex) for the remainder of the year to conduct drilling in the Green River Basin’s Pinedale Anticline.

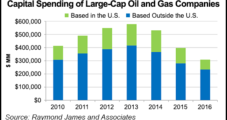

Global NatGas, Oil Capex Reductions at ‘Unprecedented’ Level, Says Raymond James

The global oil and natural gas industry has responded to the commodity meltdown with severe curtailments in capital spend, but the level of austerity implemented worldwide is unprecedented and undoubtedly will lead to a supply response, according to a survey of top-tier operators by Raymond James & Associates Inc.

Raymond James Says E&Ps Focused on Lower 48 Cutting Capex Most

The biggest capital spending reductions in the global oil and natural gas industry are — no surprise — led by producers whose assets are concentrated in the Lower 48 states, Raymond James & Associates Inc. said Monday.