An affiliate of Enterprise Products Partners LP has agreed to acquire the midstream business and assets of Azure Midstream Partners LP and its operating subsidiaries in East Texas and North Louisiana.

Buying

Articles from Buying

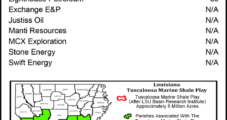

Goodrich Growing TMS, Cutting Costs

Goodrich Petroleum Corp. is buying a 66.7% working interest in producing assets and about 277,000 gross acres in the Tuscaloosa Marine Shale (TMS) for $26.7 million as it continues to build scale in the play and improve its drilling performance.

Goodrich Growing TMS Position, Reducing Drilling Costs

Goodrich Petroleum Corp. is buying a 66.7% working interest in producing assets and about 277,000 gross acres in the Tuscaloosa Marine Shale (TMS) for $26.7 million as it continues to build scale in the play and improve its drilling performance.

EQT Midstream Unit Adds Sunrise to Appalachian System

EQT Midstream Partners LP agreed to pay up to $650 million for Appalachian-focused Sunrise Partners LP and a new transportation agreement, the company said Monday.

Crestwood Taking Half Stake in Niobrara Gathering System

Crestwood Niobrara LLC is buying a 50% interest in Jackalope Gas Gathering Services LLC from RKI Exploration & Production LLC for $108 million, parent Crestwood Midstream Partners LP said Monday.

Natural Resource Partners Enters Bakken with Abraxas Deal

Natural Resource Partners LP (NRP) is buying nonoperated working interests in Bakken/Three Forks producing oil and gas properties from Abraxas Petroleum Corp. for $35.3 million in cash, marking its entry into the Bakken Shale.

Atlas Buying Raton, Black Warrior, Arkoma Basin Assets

Atlas Energy LP (ATLS) exploration and production (E&P) subsidiary Atlas Resource Partners LP (ARP) is buying 466 Bcf of natural gas proved reserves in the Raton (New Mexico) and Black Warrior (Alabama) basins from EP Energy E&P Co. LP (EP Energy), a unit of EP Energy LLC, for $733 million.

Summit Midstream Buys Bakken, Marcellus Gathering

Dallas-based Summit Midstream Partners LP (SMLP) is buying two shale gas gathering systems — one in the Bakken and the other in the Marcellus — in two deals worth a combined $460 million. The Marcellus transaction marks the company’s entry into the play.

Summit Midstream Spends $460M on Bakken, Marcellus Gathering

Dallas-based Summit Midstream Partners LP (SMLP) is buying two shale gas gathering systems — one in the Bakken and the other in the Marcellus — in two deals worth a combined $460 million. The Marcellus transaction marks the company’s entry into the play.

McClendon Leases Office Space, Employs Chesapeake Execs

Chesapeake Energy Corp. founder Aubrey McClendon, who was forced to retire as CEO on April 1, has leased office space in Oklahoma City and lured two executives to what appears to be the start of at least one new company.