Despite the shutdown of the federal government, all of the Department of Energy’s Energy Information Administration (EIA) reports should be released on schedule this week and next, the agency said Tuesday. FERC also was conducting business as usual Tuesday for an unspecified time until its reserve funds run out. The Commodity Futures Trading Commission (CFTC) had only key personnel continuing to work.

Business

Articles from Business

Mexico Likely LNG Exporter, Sempra Exec Says

Assuming the U.S. natural gas business continues its robust growth, Mexico is likely to shift from being an importer to an exporter of liquefied natural gas (LNG), Sempra Energy International CEO George Liparidis told participants Tuesday at the Wolfe Research Power and Gas Leaders Conference in New York City.

JPMorgan’s Energy Trading Arm Facing More Scrutiny

The Department of Justice (DOJ) reportedly is investigating whether JPMorgan Chase & Co. has manipulated U.S. energy markets, but neither the department nor the company will comment on the reports.

U.S. Onshore Drives Anadarko’s Global Production

Boosted by its growing U.S. onshore business, Anadarko Petroleum Corp. reversed year-ago losses in the second quarter and reported production gains in most of its domestic plays.

LNG Approval Delays Costing Billions, Think Tank Says

Pro-business Washington, DC, think tank American Council for Capital Formation (ACCF) has a new paper extolling the benefits of exporting liquefied natural gas (LNG) that it hopes will light a fire under the U.S. Department of Energy (DOE) and its export approval process.

Industry Briefs

NGL Energy Partners LP has acquired the assets of High Roller Wells LLC’s Big Lake SWD No. 1 Ltd., a Texas limited partnership. The Big Lake acquisition expands NGL’s water services business by adding a high-capacity, strategically located, oil and gas water disposal facility to its portfolio of water treatment and gathering infrastructure. The acquisition brings an 25,000 barrels of disposal capacity in the growing Permian Basin in West Texas, the company said.

Industry Briefs

Northern Natural Gas Co. on behalf of its business, Southern Natural Gas and Florida Gas Transmission, has asked the Federal Energy Regulatory Commission for approval to abandon in place the Matagorda Offshore Pipeline System (MOPS), which includes offshore facilities and onshore facilities in Texas because they are “grossly underutilized.” During April, the MOPS system transported less than 6,500 Dth/d, a fraction of the system’s original design capacity of 480,000 Dth/d, Northern Natural said. In August 2012, FERC approved Northern’s request to abandon the MOPS Phase III facilities; Northern now wants authority to abandon the first two phases, which consist of about 55 miles of 24-inch diameter pipeline that begin at Matagorda Block 686 and continue to onshore facilities at Tivoli, TX. In addition to dwindling pipeline volumes, evidence demonstrates that production declines are permanent, Northern said. FERC denied Northern’s original plea to abandon the Phase I and II facilities in an April 2011 order. At that time, there were 17 production points (out of the original 30), and now there are only four production points tied into the MOPS system, Northern said.

ExxonMobil, Chevron Investors Once Again Veto Shale Proposals

For the fourth year in a row, ExxonMobil Corp. and Chevron Corp. investors soundly defeated proposals calling for more disclosures regarding shale extraction operations.

Ohio Reports Utica Production, Predicts Leader by 2015

The Ohio Department of Natural Resources (ODNR) said 87 wells in the Utica Shale collectively produced 12.84 Bcf of natural gas and more than 635,000 bbl of oil in 2012.

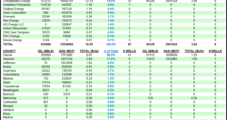

Quarterly Briefs

Quicksilver Resources Inc. is continuing to “hammer on the cost side” of its business, deferring elective spending in the energy patch and cutting back on staff. A recently announced joint venture (JV) in the Barnett Shale with Tokyo Gas Co. Ltd. was welcome news (see NGI, April 8), but there is more work ahead. “We are focused on the most important projects and we’re bringing in partners to both reduce debt and assist in the development of our assets,” said CEO Glenn Darden. “The company is very serious about reducing costs and living within cash flows.” Over the last year, the employee count has come down by about 20%. The Fort Worth, TX-based operator reported an adjusted net loss of $6 million (minus 4 cents/share) compared with a loss in 1Q2012 of $15 million (minus 9 cents). Since it was able to complete a long-sought Barnett Shale deal and in light of “challenging” natural gas liquids pricing, the company has shelved plans to create a Barnett master limited partnership (see NGI, Nov. 12, 2012).