Royal Dutch Shell plc is moving forward with an overhaul and name change after shareholders on Friday overwhelmingly supported a plan to simplify the business structure. On the resolution to adopt the new Articles of Association, 99.8% of the voting shares were in favor of the move. The overhaul could be completed in early 2022.…

Business

Articles from Business

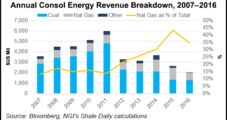

Consol to Spin Off Remaining Coal Assets, Rebrand As NatGas-Focused E&P

After years of working to rebuild the core of its business to evolve around natural gas production, Consol Energy Inc. said Tuesday that a subsidiary has filed a registration statement with the Securities and Exchange Commission to spin-off its remaining coal assets into a separate publicly-traded company.

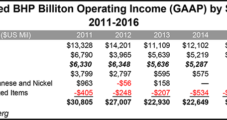

BHP’s U.S. Petroleum Business Should Still Go, Activist Says

BHP Billiton Ltd. concedes that its investment in U.S. shale plays was poorly timed but wants to make a go of it with cost-cutting and increased efficiencies. Meanwhile, an activist investor targeting the Australian mining conglomerate for reform would still like to see the U.S. petroleum business jettisoned.

Briefs — California Energy Commission

The California Energy Commission (CEC) on Wednesday awarded more than $36 million for clean energy freight transportation in the Los Angeles/Long Beach ports and other clean transportation projects — $24 million for freight transportation and $12 million for other projects. The South Coast Air Quality Management District and Long Beach Harbor Department each received $10 million, and the Los Angeles Harbor Department received $4.5 million to carry out field demonstrations of medium- and heavy-duty cargo handling equipment that have zero and near-zero emissions. Last year, CEC launched the state’sSustainable Freight Action Plan, supported by grants from the statewide alternative/renewable fuel and vehicle technology program. Zero emission and near-zero emission technologies are involved in the program.

Former Anadarko Chief Hackett to Prowl For E&P Investments as CEO of New Riverstone Entity

With one U.S. onshore producer launched last year performing above expectations, Riverstone Holdings LLC has turned to retired Anadarko Petroleum Corp. chief Jim Hackett to lead another.

With BHP Contract in Hand, Pemex Hunting for More Exploration Partners

Mexico is open for business and looking for partners to develop deepwater and onshore oil and natural gas, the director general of state-owned Petroleos Mexicanos (Pemex) said Tuesday.

Infrastructure Needs Spell Growth For MDU Resources’ Construction Unit

Now free of its oil/natural gas exploration/production (E&P) business after selling it late last year (see Daily GPI, Nov. 3, 2015), Bismarck, ND-based MDU Resources Group’s senior executives are touting the growth in the utility holding company’s substantial stake in the construction services/materials business.

NGI The Weekly Gas Market Report

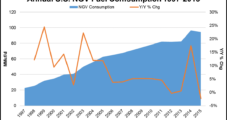

NGV Market Faces Challenges From Commodity Prices, EV Advances, Consultant Says

Low oil prices and advances in the electric vehicle (EV) sector will slow the pace of growth in the natural gas vehicle (NGV) market, according to an update to a Navigant Research report published last year.

ValueAct to Pay Record $11M Penalty For Attempting to Influence Halliburton, Baker Merger

Activist investment firm ValueAct on Tuesday agreed to pay a record $11 million to the U.S. Justice Department to settle allegations that it attempted to influence the Baker Hughes Inc. and Halliburton Co. merger, which has since been canceled.

Private OFS Operators Holding On With Price Breaks, Layoffs, Compensation Cuts

The best customers are getting the best prices for services in the U.S. onshore, but those price breaks are cutting sharply into revenues for privately held companies, a new survey has found.