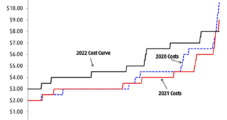

Implied costs for natural gas-weighted producers rose by 46% year/year in 2022 to $4.51/Mcfe, according to a new study by BMO Capital Markets. The three-year average cost trend rose 6% to $4.06/Mcfe, the BMO team said. This is based on a comparison to a global Brent oil and Henry Hub basket price. Viewed by the…

Brent

Articles from Brent

Shock OPEC-Plus Production Cut Galvanizes Fresh Support for Bill Targeting Cartel Price Fixing

The consortium of oil-producing countries known as OPEC-Plus spurred rare bipartisanship in the U.S. capital after the cartel said it would slash crude production. The group said last week its decision to cut output by 2 million b/d in November was in response to global recessionary headwinds and threats to demand. But Washington lawmakers on…

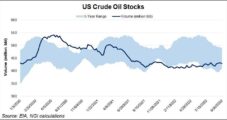

U.S. Crude Production Flat Amid Global Supply Worries; OPEC-Plus on Deck

American oil producers were active by 2022 standards last week. However, total output held flat for the third straight period and remained far below pre-pandemic levels, the U.S. Energy Information Administration (EIA) said Wednesday. Production for the week ending April 29 totaled 11.9 million b/d, according to EIA. That was on par with the high…

Domestic Crude Production Reaches New 2022 High; Imports Drop

U.S. oil production for the week ended April 15 climbed to 11.9 million b/d, setting a new highpoint for the year, the U.S. Energy Information Administration (EIA) said Wednesday. That marked a 100,000 b/d increase from the prior week and a notable bump from the level maintained through much of the first quarter, EIA’s latest…

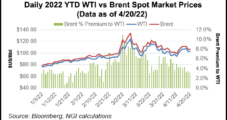

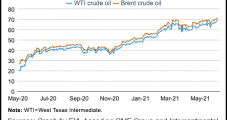

Brent Crude Prices to Average $87 in February Before Declining Later in 2022, EIA Predicts

Amid continuing draws on inventories, global Brent crude oil prices are on track to average $90/bbl this month before declining later in 2022 on production growth domestically and abroad, according to updated modeling from the Energy Information Administration (EIA). Brent crude oil spot prices rose $12 month/month to average $87 in January, EIA said in…

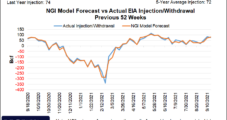

October Natural Gas Futures Skyrocket Ahead of Expiration, Reach New 2021 High

Natural gas futures sailed higher on Monday, rallying for a third straight session ahead of prompt month expiration and amid a potential global energy supply crunch. The October Nymex contract spiked 56.6 cents day/day and settled at $5.706/MMBtu. October rolls off the board as the prompt month at the close of trading Tuesday. November jumped…

Oil Price Boom Forecast to Reach $100, Potentially Marking Crude’s Last Great Rally

As major economies across the globe emerge from the doldrums of the pandemic and travel surges, oil prices could further spike and reach $100/bbl by next year, according to the most bullish Wall Street forecast yet this year. It could also mark the final surge in oil prices, however, as pressure intensifies on energy companies…

Brent Oil Prices to Decline into 2022 as Global Production Escalates, Says EIA

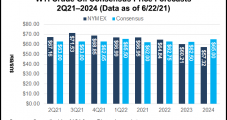

Brent prices are forecast to average $68/bbl in 3Q2021 before production worldwide begins to escalate, sending the average price down to around $60/bbl in 2022, the Energy Information Administration (EIA) said Tuesday. In the Short-Term Energy Outlook, researchers noted that Brent averaged $68/bbl in May, a 25% uptick from January. “In the coming months, we…

Warmer Forecasts Push Up Global Natural Gas Prices — LNG Recap

Global natural gas prices moved higher Tuesday, recovering losses late last week as a warmer shift in forecasts was seen lifting demand in places like the United States and Asia. In Europe, where colder spring weather has been driving abnormal heating demand for this time of year, temperatures are heating up. Natural gas prices on…

Brent Forecast to Slide to $61 Later in Year, but Henry Hub Prices Higher, Says EIA

Brent crude oil prices are set to average $65/bbl during the second quarter before declining to $61 for the second half of 2021, the Energy Information Administration (EIA) said in the May edition of its Short-Term Energy Outlook (STEO). In the report, published Tuesday, EIA said Brent prices averaged $65 in April, unchanged from March.…