Executives expressed a more optimistic outlook on capital availability and commodity pricing for the oil and gas sector in the latest editions of two surveys conducted by Haynes and Boone LLP. Most respondents to the law firm’s spring 2021 Borrowing Base Redeterminations Survey forecast that borrowing bases will rise by 0-10% this spring versus fall…

Borrowing

Articles from Borrowing

And the Survey Says: Producers Facing Rough Fall Redetermination Season

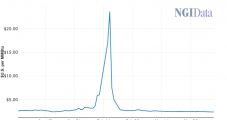

For the first time in three years, oil and natural gas producers are expected to see their borrowing bases decline as credit availability contracts on a worsening outlook for commodity prices, according to a survey of 221 industry respondents conducted last month by Haynes and Boone LLP.

Two Appalachian E&Ps Secure Additional Financing

Funds managed by subsidiaries of the energy-focused investment firms Triloma Financial Group and EIG Global Energy Partners have committed $300 million to Northeast Natural Energy LLC.

Gastar Closes on Sale of Noncore Assets; Borrowing Base Trimmed to $85M

Midcontinent pure-play operator Gastar Exploration Inc. said it has closed on the sale of certain noncore assets in Oklahoma to an undisclosed buyer for $74.7 million, and that its borrowing base has been trimmed to $85 million.

Higher Oil Prices Coming at Opportune Time For Spring Redetermination Season

Oil prices began to move higher in the last few days on an announcement that producers from in and outside the Organization of the Petroleum Exporting Countries (OPEC) will hold talks in mid-April to consider freezing output — news that may be favorable as U.S. operators meet with their lenders to redetermine their borrowing abilities.

U.S. E&Ps Arming For Spring Bank Redeterminations

The pain for U.S. exploration and production (E&P) companies may not be over as commercial banks begin their spring borrowing base redeterminations, which have the potential to reduce debt limits and begin a wave of restructuring, analysts with Raymond James & Associates said Monday.

Midstates Making $620M Anadarko Basin Acquisition

Midstates Petroleum Co. Inc. is buying producing properties, as well as developed and undeveloped acreage, in the Anadarko Basin in Texas and Oklahoma for $620 million in cash from Panther Energy LLC and its partners Red Willow Mid-Continent LLC and Linn Energy Holdings LLC.

Ultra CEO: ‘2012 Was A Train Wreck’

Darrell Royal, the revered former head coach for the University of Texas football team, used to explain his team’s success by borrowing a line from a 1920s song, “You dance with the one that brung ya.” Ultra Petroleum Corp., which has stuck with natural gas while others have moved along, is discovering that gas can be one expensive date.

Magnum Hunter Aims to Capitalize on Acquisitions in 2011

Despite reporting a $16.3 million net loss for 2010, Magnum Hunter Resources Corp. believes that recent and pending acquisitions could help the company more than triple production, allowing it to compete with bigger companies in three major shale plays.

Chesapeake Dropping Down Haynesville Gathering System

Chesapeake Midstream Partners LP has agreed to acquire the Spring Ridge gas gathering system and related facilities in the Haynesville Shale from Chesapeake Midstream Development LP, a subsidiary of Chesapeake Energy Corp. (Chesapeake), for $500 million cash.