Only weeks after slapping down $5.4 billion to take over NexTier Oilfield Solutions, Patterson-UTI Inc. on Wednesday agreed to buy global drillbit specialist Ulterra Drilling Technologies LP. In the definitive agreement with sponsor Blackstone Energy Partners, Patterson-UTI agreed to pay $370 million cash and trade 34.9 million common shares. Patterson-UTI was trading for around $12.20/share…

Tag / Blackstone

SubscribeBlackstone

Articles from Blackstone

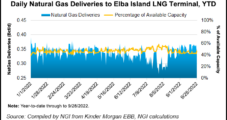

Kinder Sells Quarter Stake in Elba Island LNG for $565M

Kinder Morgan Inc. (KMI) has completed the sale of a 25.5% equity stake in Elba Liquefaction Co. LLC (ELC) to an undisclosed buyer for about $565 million, management said Tuesday. ELC, a joint venture between KMI and Blackstone Credit, owns the 2.5 million metric tons/year Elba Island LNG export terminal in Chatham County, GA. KMI…

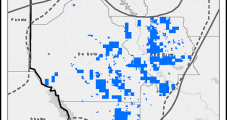

Vine Energy CEO Says Haynesville Primed for ‘Improving Natural Gas Fundamentals,’ Exports

As U.S. natural gas demand improves, Vine Energy Inc. expects its production in Northwest Louisiana to increasingly be sourced for overseas exports, the company’s CEO said Monday. The Plano, TX-based independent in the spring of 2021 took the company public to secure more investor interest in its 227,000 net acre stronghold in the Haynesville and…

Blackstone Sells Stake in Cheniere MLP for $7B

Blackstone Group Inc. has closed the sale of its 42% stake in Cheniere Energy Inc.’s master limited partnership (MLP) in a transaction valued at $7 billion. The private equity firm sold the units it held in Cheniere Energy Partners LP (CQP) to affiliate Blackstone Infrastructure Partners and Brookfield Infrastructure. The firm first invested $1.5 billion…

Blackstone Tries to Make Tallgrass a ‘Take Private’ Offer It Can’t Refuse

Tallgrass Energy LP (TGE) has received a “take private” proposal from private equity firm Blackstone offering to buy up the master limited partnership’s stock at a premium, management revealed late Tuesday.

Texas Drillbit Manufacturer Gains Blackstone as Majority Stakeholder

Blackstone Energy Partners has binding agreements in hand to acquire a majority stake in Ulterra Drilling Technologies, a drillbit manufacturer that works across North America, from affiliates of American Securities LLC.

Falcon to Soar in Eagle Ford with Osprey, Royal Combination

Osprey Energy Acquisition Corp. on Monday agreed to acquire private equity-backed Royal Resources’ Eagle Ford Shale assets in a transaction estimated to be worth $894 million.

Investors Embrace ETP’s $1.57B Rover Deal, But Project Still Under Scrutiny

Energy Transfer Partners LP’s (ETP) plans to sell a 32.44% stake in its Rover Pipeline to private equity for $1.57 billion met with generally positive reactions from investors Tuesday, but the project still faces uncertainty amid scrutiny from regulators and from Congress.

U.S. Energy Sector Secures Billions in Saudi Deals

U.S. oil and natural gas operators inked deals over the weekend with Saudi Arabia that are expected to create billions in revenue as President Trump completed the first leg of a nine-day marathon trip to the Middle East and Europe.

Blackstone Paying $2B For Permian Basin Gathering, Processing System

Midland, TX-based EagleClaw Midstream Ventures LLC and its sponsor, EnCap Flatrock Midstream, are selling the company to funds managed by Blackstone Energy Partners and Blackstone Capital Partners for $2 billion in cash.