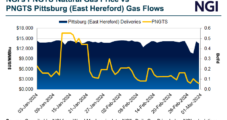

TC Energy Corp. has inked a $1.14 billion agreement to sell the Portland Natural Gas Transmission System (PNGTS) to BlackRock Inc. and Morgan Stanley Infrastructure Partners as it pares debt and streamlines its North American pipeline business. The Calgary-based pipeline giant holds 61.7% ownership of PNGTS, a 295-mile, 290 million Dth/d line. Énergir LP subsidiary…

Blackrock

Articles from Blackrock

Aramco Sells 49% Stake in Natural Gas Infrastructure in $15.5B Deal with BlackRock-Led Consortium

Saudi Arabian Oil Co., aka Aramco, on Tuesday agreed to take $15.5 billion for a 49% interest in its natural gas pipeline infrastructure to a consortium led by BlackRock Inc. In the transaction, newly formed Aramco Gas Pipelines Co. would have lease and leaseback usage rights of the network over a 20-year period. BlackRock clinched…

Valero, BlackRock and Navigator Join Forces to Build 1,200-Mile CCS Pipeline Across Midwest

Valero Energy Corp. and a unit of BlackRock Inc. are teaming up with Navigator Energy Services to develop an industrial-scale pipeline to gather, transport and store carbon dioxide (CO2) emissions from sites in five Midwest states. San Antonio-based Valero agreed to anchor the carbon capture and storage (CCS) system with a unit of the giant…

BlackRock to Allocate Less to Fossil Fuels, More to Sustainable Prospects

BlackRock Inc. founder and CEO Larry Fink this week said the company will shift how investments are allocated and exit stocks that “present a high sustainability-related risk,” including from some fossil fuel projects.

NGI The Weekly Gas Market Report

BlackRock Shifting Capital Allocation to Sustainable Projects, Fewer Fossil Fuels

BlackRock Inc., the world’s No. 1 asset manager with nearly $7 trillion in investments, plans to shift how funds are allocated, which could include exiting stocks that “present a high sustainability-related risk,” including for some fossil fuels projects.

Refracks Focus of Halliburton, BlackRock Venture

Halliburton Co., which performs more onshore well stimulations than any other operator in North America, is carving out a niche in the refracturing market in a partnership with private equity giant BlackRock.

BlackRock Fined $12M For Former Fund Manager’s Ties to Rice Energy

The U.S. Securities and Exchange Commission (SEC) has fined the global money management and investment firm BlackRock Inc. $12 million for failing to disclose a conflict of interest between former portfolio manager Daniel J. Rice III, the funds he managed and his family business.

BlackRock Fined $12M For Former Fund Manager’s Ties to Rice Energy

The U.S. Securities and Exchange Commission (SEC) has fined the global money management and investment firm BlackRock Inc. $12 million for failing to disclose a conflict of interest between former portfolio manager Daniel J. Rice III, the funds he managed and his family business.

SEC Investigating Former BlackRock Fund Manager’s Ties to Rice Energy

The U.S. Securities and Exchange Commission (SEC) could take action against the global asset and investment firm BlackRock Inc. after an investigation into a former employee, Daniel J. Rice III, revealed a potential conflict of interest between the portfolios he managed and his family business, Rice Energy Inc., according to an 8-K filed by the firm Friday.