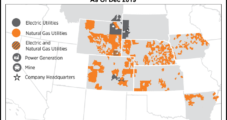

A Colorado regulatory judge has recommended Black Hills Corp.’s multi-state efforts to consolidate natural gas operations into a single utility be denied.

Black

Articles from Black

Cotton Valley Agreement to Add More Natural Gas Infrastructure

Black Bear Midstream, a portfolio company of funds managed by Oaktree Capital Management LP, has secured a seven-year natural gas gathering and processing agreement in Louisiana’s Desoto and Caddo parishes with an undisclosed Cotton Valley producer.

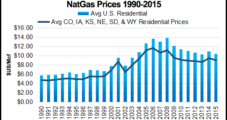

Black Hills Cost-of-Service NatGas Reserves Program in Limbo

A long-standing effort to create a multi-state, multi-utility natural gas reserves program centered on Piceance Basin reserves continues for Rapid City, SD-based Black Hills Corp. but the program will not move ahead this year and its ultimate fate is still uncertain, executives said Friday.

Pace Slows, Partners Sought on Black Hills Utility Gas Reserves Plan

Regulatory timing has been pushed back on Rapid City, SD-based Black Hills Corp.’s longstanding plans to launch a multi-utility natural gas reserves program as it searches for partners and the right reserves mix for the venture.

Brief — Fortem Resources

Las Vegas, NV-based Fortem Resources Inc., a publicly traded holder of oil/natural gas properties in western Canada and Utah, has acquired a working interest and related leases in 165,000 acres in southeast Utah from Black Dragon LLC. The acreage is in the Moenkopi Formation in Carbon and Emery counties, adjoining the Grassy Trails oilfield, which has produced 731,000 bbls of crude from the Moenkopi. Fortem is obtaining Black Dragon’s 75% working interest in certain leases, hydrocarbons, wells, agreements, equipment, surface rights agreements and assignable permits totaling up to 258 sections of land with an 80% revenue interest. Fortem and Black Dragon entered into and closed a membership interest purchase agreement, with Fortem acquiring all of Black Dragon’s interest.

Black Hills Not Giving Up on Mancos Utility Cost-of-Service Gas Reserves, CEO Says

With a continuing vision of riding its Mancos Shale holdings to successful development, Rapid City, SD-based Black Hills Corp.’s CEO has reiterated the multi-state utility holding company’s desire to establish a series of utility cost-of-service natural gas reserve programs.

Black Hills Pulls Back Multi-State Utility Gas Reserve Proposal

Rapid City, SD-based Black Hills Corp. has suspended its push in six states to create utility cost-of-service natural gas reserve programs and is rethinking its approach, CEO David Emery said during a 2Q2016 earnings conference call on Thursday.

Colorado Regulators Reject Black Hills’ Utility-Backed Gas Reserves

The Colorado Public Utilities Commission (PUC) on Wednesday rejected a proposed utility ratepayer-backed natural gas reserves acquisition program pursued by Rapid City, SD-based Black Hills Corp.’s gas utility in the state. This is the first of up to six state approvals being sought for similar programs in other states where Black Hills has utility operations (see Daily GPI,Oct. 5, 2015).

Colorado Regulators Reject Black Hills’ Utility-Backed Gas Reserves

The Colorado Public Utilities Commission (PUC) on Wednesday rejected a proposed utility ratepayer-backed natural gas reserves acquisition program pursued by Rapid City, SD-based Black Hills Corp.’s gas utility in the state. This is the first of up to six state approvals being sought for similar programs in other states where Black Hills has utility operations (see Daily GPI,Oct. 5, 2015).

Briefs — Williams-Energy Transfer, Black Hills Corp.

The Delaware Court of Chancery has granted a motion by The Williams Companies Inc. to expedite litigation it initiated against Energy Transfer Equity LP (ETE), which challenges a private offering of Series A Convertible Preferred Units that ETE disclosed on March 9. Williams sued ETE and CEO Kelcy Warren, in two separate lawsuits, over the matter earlier this month (see Daily GPI,April 6). The litigation against ETE seeks to unwind the private offering. The litigation against Warren, in the district court of Dallas County, TX, is for wrongful interference, through the private offering, with a merger agreement executed in September 2015 (see Daily GPI,Sept. 28, 2015). The Williams board still supports the merger, the company said.