The Federal Reserve Board (FRB) said activity in the energy industry was a mixed bag and mentioned shale only once — but in a positive light — in the latest edition of the “Beige Book,” a report published eight times a year with data provided by the 12 Federal Reserve Districts.

Biggest

Articles from Biggest

Eagle Ford an Oil Production Barn Burner, Say Analysts

The Eagle Ford Shale of South Texas is likely the biggest potential driver of U.S. oil production growth for the next five to 10 years with production on track to pass 1 million b/d by the middle of next year and 1.7 million b/d by the end of 2015, analyst at Raymond James & Associates said in a note Monday.

EnerVest Expects Utica Sale Before Year’s End; Barnett Picking Up

EnerVest Ltd., the second biggest leaseholder in the Utica Shale after Chesapeake Energy Corp., should complete the sale of a big chunk of its leasehold by the end of the year, CEO John Walker said Friday. The property sale could fetch as much as $6 billion for the privately held Houston operator and publicly traded arm EV Energy Partners (EVEP).

NatGas Supplier Plans to Tap Into Constitution Pipeline

Constitution Pipeline Co. LLC said Friday it would work with Leatherstocking Gas Co. LLC, a New York-based natural gas supplier, to pursue agreements to design, build and operate delivery interconnects along the natural gas pipeline’s proposed 121-mile route, essentially converting it to an “open access pipeline.”

Onshore Oilfield Service Margins Falling, Says IHS

Drilling demand from North America’s shale boom, as well as the beginnings of a recovery in the Gulf of Mexico, revved the four biggest domestic oilfield service companies in 2010 and 2011, but this year has been a different story, according to a review by IHS Inc.

Oilfield Service Company Onshore Margins Falling

Drilling demand from North America’s shale boom, as well as the beginnings of a recovery in the Gulf of Mexico, revved the four biggest domestic oilfield service companies in 2010 and 2011, but this year has been a different story, according to a review by IHS Inc.

Need for Constitution Pipeline Questioned Based on Alternative Marcellus Lines

The U.S. Fish and Wildlife Service (FWS) has called on FERC to consider proposed and existing natural gas pipeline projects for transporting Marcellus shale gas to New York as alternatives to the proposed Constitution Pipeline.

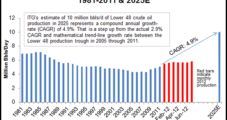

Marcellus Is Biggest Fish in a 1.1 Qcfe U.S. Shale Gas Pond

Lower 48 onshore oil and gas reserves are a huge energy pond, about 1.1 Qcfe worth, and the Marcellus Shale is its biggest fish. According to new research from Calgary-based ITG Investment Research, “the Marcellus dwarfs any other resource at 330 Tcfe, followed by the Eagle Ford and Bakken [shales] at 152 Tcfe (25 billion boe) and 72 Tcfe (12 billion boe), respectively.

North Dakota Fertilizer Plant Proposal May Use Flared Gas

In an attempt to leverage the state’s two biggest industries, North Dakota is considering construction of a world-scale, $1.5 billion nitrogen fertilizer plant. The plant could make use of some of the state’s natural gas now being flared in the face of low prices to fuel the facility, while the North Dakota Corn Growers Association (CGA) would use the plant to make anhydrous ammonia.

TransCanada: Six Years Until Canada’s Entry into Global Energy Markets

Canadian energy merchants will break out of North America and into overseas markets within six years, predicts the nation’s biggest pipeline empire. Exports of liquefied natural gas (LNG) will begin from new tanker terminals on the Pacific Coast of British Columbia (BC) at Kitimat in late 2017, TransCanada Corp. has told the National Energy Board (NEB).