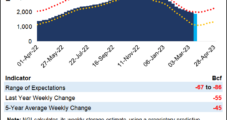

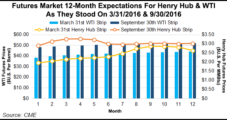

Natural gas futures probed higher early Monday, with bulls seizing upon favorable near-term weather, steady export demand and market expectations for a seasonally robust inventory withdrawal. But intensifying stress in the global financial system ultimately curbed the momentum and left futures in the red as markets closed. At A Glance: Mixed weather outlook All eyes…

Banks

Articles from Banks

Global Natural Gas Prices Keep Falling as Demand Weakens, Banking Crisis Weighs on Markets – LNG Recap

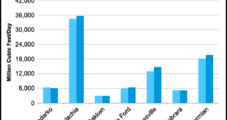

Global natural gas prices continued falling Monday, picking up where they left off last week amid warmer weather, ample supplies and turmoil in the banking sector that has weighed on commodities. In Europe, the May Title Transfer Facility (TTF) contract fell 13% last week. It gave up another 8% on Monday and closed at its…

Oil, Natural Gas Lenders Optimistic on 2022 Growth, Cautious Long Term

Banks that actively lend to the oil and natural gas sector are upbeat about strong commodity prices and rising production activity that necessitate new and expanded exploration and drilling projects – and financing to make it happen. Some are reporting loan growth as a result. Others look for increased lending to develop as the year…

Energy Lenders Optimistic on Continued Oil, Gas Recovery

While still cautious, banks with substantial exposure to the energy sector struck more upbeat tones during the fourth quarter earnings season this month. Executives said a recovery in oil prices combined with an anticipated end to the pandemic could pave a path for stronger oil and gas revenue in 2021 and a substantial reduction in…

House Votes to Dismantle Dodd-Frank Financial Reform Act

The U.S. House of Representatives on Thursday approved a bill that would eliminate or revamp much of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was signed into law by then-President Obama after the Great Recession.

Lenders Appearing More Optimistic as E&P Fall Redeterminations Beckon

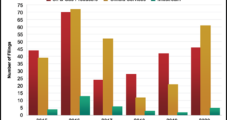

Fall redetermination season for U.S. exploration and production (E&P) companies is about to begin, with lenders more optimistic about borrowing levels, while exploration and production (E&P) companies appearing to accept that low commodity prices may be sustained.

Federal Reserve Proposes Tougher Commodities Limits on Banks

The Federal Reserve Board (FRB) issued a proposed rule calling for tougher limits on the physical commodity activities of financial holding companies (FHCs), citing the risks of such investments in the event of an environmental catastrophe.

Banks Feeling Effects of Lower For Longer Oil Prices

With low oil prices lasting longer than many expected, banks in the energy-rich 11th Federal Reserve District saw loan growth and profitability decline in 2015, according to a new report from the Federal Reserve Bank of Dallas (Fed).

S&P Downgrades Regional Banks Carrying Energy Loans as Oil, NatGas Prices Fail to Strengthen

In yet another sign that lower-for-longer commodity price sentiment has taken hold of the market, Standard & Poor’s Ratings Services (S&P) said Tuesday it downgraded four U.S. regional banks because of their large energy loan portfolios.

Many E&Ps Still Accessing Capital Markets, With Cuts ‘Relatively Light,’ Fitch Says

The sky-is-falling scenario that producers were expected to face as crude oil prices collapsed last year has yet to make a big dent in lending, according to Fitch Ratings.