Texas once again is the most attractive jurisdiction in the world for oil and natural gas investment, according to the Fraser Institute’s 11th annual global survey of energy executives.

Tag / Attractive

SubscribeAttractive

Articles from Attractive

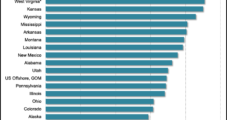

Texas, Oklahoma, Alabama Among Best Worldwide For E&P Investment, Says Fraser

The most attractive place to invest in large petroleum reserves anywhere in the world is Texas, with Oklahoma considered most attractive for medium-size reserves and Alabama the best for small reserves, according to the Fraser Institute’s Global Petroleum Survey.

‘Tectonic Shift’ Predicted in U.S. Natural Gas Demand by 2020

When U.S. natural gas prices finally moved into $4.00/MMBtu territory earlier this year, there wasn’t any rush to ramp up onshore activity, but as each month passes, it’s becoming clear that a “large wave” of domestic demand is about to unfold, according to Barclays Capital.

Williams ‘Marcellus/Utica or Bust’ Strategy Pressuring Pipeline Unit

Energy infrastructure giant Williams, whose pipeline partnership holds a bundle of huge natural gas and liquids operations in the Northeast, expects to see “full ethane rejection” through 2015, which will lead to “near-term headwinds” for the unit, CEO Alan Armstrong said Wednesday.

Rosetta: Spending, Producing More After Permian Acquisition

Rosetta Resources Inc. has raised its 2013 guidance for spending and production and increased its borrowing base in light of its pending acquisition of Permian Basin assets announced last month.

Petrochemical Investors Banking on U.S. Natural Gas

There’s hardly a place in the world more attractive today to petrochemical investment dollars than North America, an IHS Chemical executive said last week.

Petrochemical Investors Banking on U.S. Natural Gas

There’s hardly a place in the world more attractive today to petrochemical investment dollars than North America, an IHS Chemical executive said Tuesday.

Encana Moves Back into Haynesville

Natural gas prices may not be attractive enough for some producers, but Encana Corp.’s management team said it’s possible to make enough money in the Haynesville Shale to justify a five-rig program this year.

Encana Returns to Haynesville

Natural gas prices may not be attractive enough for some producers, but Encana Corp.’s management team said it’s possible to make enough money in the Haynesville Shale to justify a five-rig program this year.

Continental Bolts On More Bakken Opportunities

Continental Resources Inc., now the king of the Bakken Shale, has expanded its empire to an estimated 1.1 million net acres after completing a deal to buy 119,218 million acres for $649.3 million in cash. The Samson Resources Co. properties in North Dakota, primarily in Williams and Divide counties, have current production estimated at about 6,500 boe/d, 82% weighted to crude oil.