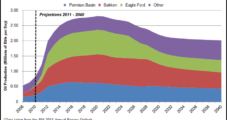

Domestic oil production may be showing signs of slowing down, but analysts with Raymond James & Associates Inc. don’t think it’s a trend.

Tag / Associates

SubscribeAssociates

Articles from Associates

Shell Granted Another Extension on Proposed Cracker Site

A subsidiary of Royal Dutch Shell plc has signed a second, six-month extension that gives it more time to decide whether to purchase property in western Pennsylvania that could ultimately be used for a “world scale” ethane cracker in the heart of the Marcellus Shale region.

Eroding Summer CDD Forecast Could Slam Fall Prices, Analysts Say

When the Energy Information Administration (EIA) releases its storage report on Thursday for the week ending June 14, analysts at Stephen Smith Energy Associates predict it will show natural gas storage at 2,435 Bcf, an increase of 88 Bcf from EIA’s previous report.

Higher Natural Gas Prices Indicate ‘Very Slow’ Drilling Recovery

The summer market for natural gas has improved for producers, but there are obstacles still in play, according to an analysis by Raymond James & Associates Inc.

Activist Fund Nominates Five to Hess Board, Urges Shale Spin-Off

Elliott Associates LP, a hedge fund that owns a 4% stake in Hess Corp., is urging other shareholders to elect its five nominees to the company’s board of directors and has called on Hess to spin off its assets in the Bakken, Eagle Ford and Utica shale plays.

Activist Fund: Hess Corp. Misplaying a Great Hand

Elliott Associates LP, a hedge fund that owns a 4% stake in Hess Corp., is urging other shareholders to elect its five nominees to the company’s board of directors and has called on Hess to divest from other businesses and spin off its assets in the Bakken, Eagle Ford and Utica shale plays.

Marcellus Gas Output Only Going Higher, Says Analyst

Raymond James & Associates Inc. on Tuesday revised upward its 2013 U.S. natural gas production forecast to average about 66.8 Bcf/d, up 1.3 Bcf/d from a previous forecast, mostly because Marcellus Shale output has not declined, while associated gas from oil drilling is only adding to the surplus.

U.S. Natural Gas Prices May Spike to ‘Near $5’ in Early 2013

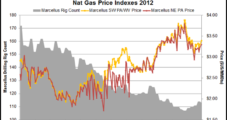

Raymond James & Associates Inc. on Monday raised its 4Q2012 natural gas price assumptions by 75 cents and lifted the 2013 forecast by 50 cents, predicting 1Q2013 price “spikes to near $5.00/Mcf.”

Raymond James: Natural Gas Rigs to Slow Descent in 2013

Raymond James & Associates Inc. energy analysts last week modestly reduced their near-term outlook for U.S. drilling activity and raised expectations for 2013, but only slightly. Drilling activity in the coming year still is “much lower than consensus expectations,” but the natural gas rig count should begin to stabilize.

Raymond James: Natural Gas Rig Count to Slow Descent in 2013

Raymond James & Associates Inc. energy analysts on Monday modestly reduced their near-term outlook for U.S. drilling activity and raised expectations for 2013, but only slightly. Drilling activity in the coming year still is “much lower than consensus expectations,” but the natural gas rig count should begin to stabilize.