Linn Energy Inc. has agreed to sell a portion of its assets in California’s San Joaquin Basin to an undisclosed buyer for $263 million as it continues to reduce its debt.

Assets

Articles from Assets

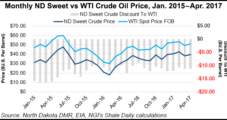

After Disappointing Bids, SM Energy Postpones Sale of North Dakota Assets

SM Energy Co. said it has indefinitely postponed plans to sell its assets in Divide County, ND, after receiving bids that were lower than the company’s expectations.

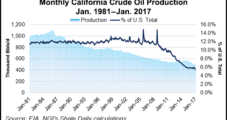

California Resources, Macquarie in $160M JV to Expand San Joaquin E&P Activity

Following up on a strategy to shift fromdefense to offense this year, Los Angeles-based California Resources Corp. (CRC) on Wednesday entered another joint venture (JV) to boost exploration and production (E&P) activity.

Venoco Files Second Chapter 11 Bankruptcy; California Offshore to Be Sold, Shut

For the second time in the past 13 months, Denver-based Venoco LLC and its affiliates in the exploration and production (E&P) sector in California on Monday filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of Delaware. It marks the end of an era for part of California’s contentious offshore drilling history, which helped define the U.S. environmental movement of the past 50 years.

ConocoPhillips Bidding Farewell to Gassy San Juan Basin in $3B Deal With Hilcorp

Houston-based ConocoPhillips, the largest operator in the natural gas-rich San Juan Basin, agreed Thursday to sell the portfolio for up to $3 billion to an affiliate of Hilcorp Energy Co.

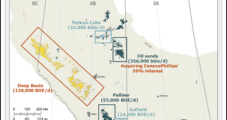

Cenovus Doubling Canada Output, Adding Gas-Rich Montney in $13.3B Deal With ConocoPhillips

Calgary-based Cenovus Energy Inc. is taking full control of some Western Canadian oilsands assets and adding three million net acres to its natural gas-rich Deep Basin portfolio in a transformative $13.3 billion (C$17.7 billion) transaction with ConocoPhillips.

Mammoth Secures More Frack Sand With Chieftain Acquisition

Two days after Mammoth Energy Services Inc. snapped up key onshore oilfield assets, including a major sand supplier, the Oklahoma City-based company on Thursday picked up substantially all of the assets of Chieftain Sand and Proppant LLC for $35.25 million.

Linn Emerging from Bankruptcy Sans Berry, With Onshore Assets For Sale

Linn Energy LLC, the natural gas-rich powerhouse partnership thatsuccumbed to bankruptcy last year, has emerged from Chapter 11 with a streamlined strategy that will cast off a big package of onshore U.S. assets and jettison the Berry Petroleum franchise it acquired in 2013.

Sanchez Eager to Close on Eagle Ford Acquisition, Tackle DUC Inventory

One month after announcing it would expand its position in the Eagle Ford Shale, Sanchez Energy Corp. on Wednesday laid out plans for 2017 to boost its capital expenditures (capex) budget and tackle the acquisition’s complement of drilled but uncompleted (DUC) wells.

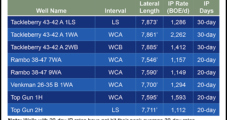

SM Energy Midland Basin ‘RockStar’ Well IP Rates Chart High

The Permian Basin remains red hot as SM Energy Co. on Tuesday released results of eight new Midland Basin wells in Howard County, TX, where the company will be focusing a substantial amount of its drilling effort this year.