As operators use their capital for faster-to-market onshore prospecting, offshore exploration has declined and with it dealmaking, according to IHS Markit.

Assets

Articles from Assets

Briefs — BLM Lease Sale

The U.S. Bureau of Land Management (BLM) in Utah is planning to offer 75 oil and gas parcels within 94,000 acres in Duchesne, Uintah and Emery counties in an online December quarterly lease sale. BLM said the leases would contain stipulations and best-management practices aimed at addressing air quality and water resources and ensuring the “safe and environmentally responsible” development. BLM also may modify the stipulations to accommodate site-specific resources. Last year, leasing on BLM lands in Utah contributed $1.7 billion to the economy, supporting 9,700 jobs, according to the federal agency.

BHP Actively Marketing Permian, Haynesville, Eagle Ford, Fayetteville

BHP Billiton Ltd., whipsawed by sharp impairments and activist investors that want the company to train its development solely on conventional oil and mining, is actively marketing its U.S. onshore portfolio, an 800,000-plus leasehold that runs through the Permian Basin, Haynesville, Eagle Ford and Fayetteville shales.

4 AM Acquiring Oklahoma Midstream Properties from White Star

Oklahoma City-based independent White Star Petroleum LLC has sold its midstream gathering system and associated assets in the state’s stacked reservoirs to 4 AM Midstream, a cross-town operator, for an undisclosed amount.

Silver Run STACK-ing Assets in Takeover of Alta Mesa, Kingfisher Midstream

Houston’s Silver Run Acquisition Corp. II, helmed by former Anadarko Petroleum Corp. chief Jim Hackett, agreed late Wednesday to combine with Oklahoma-focused producer Alta Mesa Holdings LP and Kingfisher Midstream LLC.

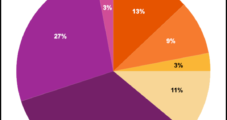

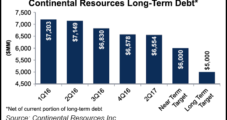

Continental Sells Assets to Focus on Debt Reduction, While NatGas Output Jumps Almost 17%

Continental Resources Inc. CEO Harold Hamm said he would use asset sales and reduce activity in the Midcontinent, including the Springer Shale, to pare down long-term debt, which stood at $6.56 billion at the end of June.

Energy Transfer Nears Takeover of North Louisiana-Focused PennTex

Energy Transfer Partners LP (ETP) said Tuesday it has nearly completed a takeover of fellow Dallas-based partnership PennTex Midstream Partners LP.

Encana Selling Piceance Natural Gas Assets For $735M

Encana Corp. on Friday agreed to sell its natural gas assets in Colorado’s Piceance Basin, including 550,000 net acres and 3,100 operated wells to Denver-based Caerus Oil and Gas LLC in a deal valued at $735 million.

Linn Exiting California With $100M Sale in Los Angeles Basin

Linn Energy Inc. is completing its exit from California with the sale of some properties in the Los Angeles Basin to an undisclosed buyer for $100 million.

Brief — PennTex Midstream

The general partner ofPennTex Midstream Partners LP has recommended that its unitholders accept a tender offer of $20/unit from Energy Transfer Partners LP (ETP) for all of the partnership’s outstanding common units. PennTex has assets in North Louisiana. Last fall, ETPannounced a $640 million deal to acquire an interest in the assets, which serve Range Resources Corp., among other producers. PennTex received the unsolicited offer from ETP last month.