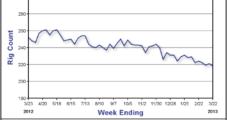

The recent surge in natural gas prices may have provoked some optimism in the energy sector, but it’s not enough to encourage more drilling, according to Barclays Capital, which expects the rig count to not surpass 450 this year.

Arkoma

Articles from Arkoma

Bakken-Fueled Continental Aiming to Triple Output, Reserves

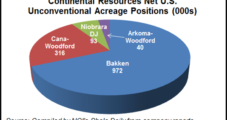

Continental Resources Inc. has launched a growth plan to triple production and proved reserves between now and the end of 2017, largely from its leading Bakken Shale position, but also with gains from other onshore holdings, including a discovery in the southwest corner of Oklahoma.

Industry Briefs

Houston-based Vanguard Natural Resources LLC has closed on its acquisition of natural gas and liquids assets in the Arkoma Basin from Antero Resources for an adjusted price of $434.4 million, subject to post-closing adjustments. The effective date is April 1, 2012. The deal was announced early last month (see Shale Daily, June 5). Vanguard funded the acquisition with borrowings under its existing reserve-based credit facility. The borrowing base was increased from $670 million to $975 million in connection with an interim borrowing base redetermination to include the properties from the acquisition. Updated 2012 production and financial results guidance will be included with second quarter results, which are expected to be released on Aug. 2.

New Chesapeake Chairman to Take Reins This Week

Aubrey McClendon, who has run Chesapeake Energy Corp. and helmed the board of directors since he co-founded the company in 1989, officially will step down as chairman of the board at some point this week.

Industry Brief

Cardinal Midstream LLC has brought a third cryogenic gas processing plant online in the Arkoma Woodford Shale, and it now has 220 MMcf/d of operated cryogenic processing capacity in the Oklahoma play. The new Tupelo Plant in Coal County, OK, is capable of processing 120 MMcf/d. Cardinal’s Coalgate Plant, an 80 MMcf/d facility, is adjacent to Tupelo, and the Atoka Plant in Atoka County, has a capacity of 20 MMcf/d. Cardinal Midstream President R. Mack Lawrence said the company was expanding its gathering system and “evaluating further processing capacity expansions given the level of drilling activity on dedicated acreage and the quality and production volume we’re seeing from the rich gas wells in the play.”

Newfield Continues Transition to Oil Company

Newfield Exploration Co. said that in 2012 it will devote more of its capital expenditure (capex) program and boost production in natural gas liquids (NGL) and oil — at the expense of natural gas — as it looks to become an oil-weighted company by 2013.

Chesapeake Ready to Partner in Fayetteville, Marcellus — Maybe More

Chesapeake Energy Corp. last week completed the sale of its Woodford Shale assets in the Arkoma Basin to BP America Inc. for $1.7 billion in cash, and now it is looking for joint venture partners to share the costs and the rewards in its Fayetteville and Marcellus shale plays.

Chesapeake Ready to Partner in Fayetteville, Marcellus — Maybe More

Chesapeake Energy Corp. has completed the sale of its Woodford Shale assets in the Arkoma Basin to BP America Inc. for $1.7 billion in cash, and now it is looking for joint venture partners to share the costs and the rewards in its Fayetteville and Marcellus shale plays, the CEO said Tuesday.

BP to Pay Chesapeake $1.75B for Woodford Assets

BP America Inc. agreed to pay $1.75 billion in cash to acquire all of Chesapeake Energy Corp.’s interests in 90,000 net acres of leasehold and natural gas properties in the Arkoma Basin of the Woodford Shale.

Industry Briefs

Junior independent Lexington Resources Inc., which is focused on natural gas exploration in the Arkoma Basin, said Wednesday it more than doubled its drillable land holdings in Oklahoma with the acquisition of 4,600 acres of coalbed methane-targeted natural gas leases. Lexington paid $125,000 toward the farm-out lease purchase of $600,000. Acreage included in the acquisition extends over an area of mutual interest of approximately 24,320 acres. The new leases encompass rights to all possible producing zones to the base of the Hartshorne Coal Formation at estimated depths of approximately 3,000 feet and include a 79.25% net revenue interest and a 100% working interest. With the latest purchase, the Las Vegas-based producer’s land position now totals drillable acreage of almost 9,000 acres.