Enbridge Inc.’s chief executive touted the Canadian company’s efforts to further expand in the United States – on the Gulf Coast and elsewhere – as part of a bid to capitalize on expected long-term natural gas demand in North America and overseas. The Calgary, AB-based company, already a major force in Canadian and American energy,…

Tag / Aquisition

SubscribeAquisition

Articles from Aquisition

Chevron’s $53B Deal for Hess Supercharges Lower 48 Portfolio, Opens Door to Guyana’s Stabroek

Chevron Corp. agreed Monday to snap up Hess Corp. in an all-stock transaction valued at $53 billion, enlarging the supermajor’s Lower 48 and Gulf of Mexico portfolios and giving it entry into rich discoveries offshore Guyana in the Stabroek block. The total enterprise value, including debt, is $60 billion. The agreement nearly matches the estimated…

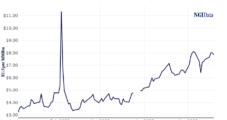

PHX Growing Haynesville, SCOOP Royalty Position Amid Natural Gas Price Slump

PHX Minerals Inc. is using the current natural gas price downturn to expand its mineral and royalty positions in the Haynesville Shale and South Central Oklahoma Oil Province (SCOOP) plays, management said Thursday. The Fort Worth, TX-based independent agreed to acquire about 988 net royalty acres in the Haynesville and SCOOP from five separate sellers…

Devon Energy Grows Williston Basin Position with $865M Deal

Devon Energy Corp. said Thursday that it has closed on its $865 million acquisition of RimRock Oil and Gas LP’s leasehold interest and related assets in the Williston Basin. The bolt-on deal, announced last month, adds 38,000 contiguous net acres (88% working interest) to Devon’s existing Williston footprint. Oklahoma City-based Devon said it expects the…

Canes Midstream Snaps Up Sizeable Permian Midland Asset Package

Private equity-backed Canes Midstream LLC said Wednesday it has closed on its acquisition of Permian Basin midstream firm Cogent Midstream LLC. Located in the southern portion of the Permian’s Midland sub-basin, the Cogent assets include 520 MMcf/d of natural gas processing capacity, over 800 miles of pipelines, 42 compressor stations, a crude oil gathering system,…

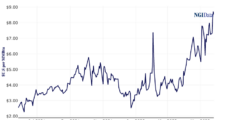

ExxonMobil Says Adios to Barnett in $750M Deal with Denver’s BKV

ExxonMobil on Thursday said goodbye to the Barnett Shale in North Texas after securing $750 million from Denver-based BKV Corp. for the natural gas-rich portfolio in North Texas. The transaction, set to be completed by the end of June, would require additional payments to ExxonMobil contingent on future natural gas prices. The deal includes 160,000…

Upstream M&A Market Lukewarm But Expected to Heat Up

When oil prices began collapsing last year a lot of prognosticators said it was only a matter of time before oil majors and large independents began eyeing their smaller brethren for takeovers. A year later, there’s little consolidation, but that should change within the next few months, experts say.