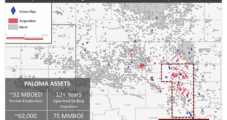

Mach Natural Resources LP is looking to expand its footprint in the Anadarko Basin of Oklahoma with the $815 million purchase of about 62,000 net acres from private equity-backed Paloma Partners IV LLC. Under the deal announced Monday, which is expected to close by the end of December, Oklahoma City-based Mach would acquire the acreage…

Tag / Anadarko Basin

SubscribeAnadarko Basin

Articles from Anadarko Basin

Natural Gas Production Declines from Appalachia, Haynesville; Permian Seen Gaining, EIA Says

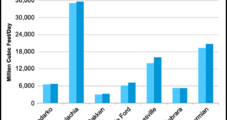

Overall natural gas production from seven major U.S. onshore regions is expected to recede from November to December but remain robust at just under 100 Bcf/d, according to updated modeling published Monday by the U.S. Energy Information Administration (EIA). The agency’s latest monthly Drilling Productivity Report (DPR) projected combined December production of 99.638 Bcf/d from…

Haynesville Continuing to Lead Natural Gas Production Growth in Latest EIA Projections

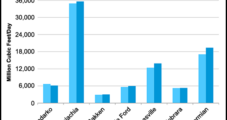

Spearheaded by the Haynesville Shale, natural gas production from seven key U.S. onshore regions will approach 95 Bcf/d in October, according to the latest modeling from the Energy Information Administration (EIA). Combined output from the Haynesville — along with the Anadarko, Appalachian and Permian basins, as well as the Bakken, Eagle Ford and Niobrara formations…

Sitio, Brigham in $4.8B Merger to Create Largest Publicly Traded Mineral, Royalty Company

Sitio Royalties Corp. and Brigham Minerals Inc. said Tuesday they have agreed to merge in a roughly $4.8 billion, all-stock transaction. The combined firm would be the largest publicly traded mineral and royalty company in the United States, according to Sitio and Brigham. The plan is to focus on industry consolidation across diverse operators and…

Marathon Oil Prioritizing Investment Grade Over Capitalizing on High Commodity Prices

Houston-based Marathon Oil Corp. held its natural gas and oil production levels relatively steady during the second quarter, a trend it plans to continue, as it prioritizes financial stability over capitalizing on lofty commodity prices. CEO Lee Tillman told investors during a 2Q2022 conference call the exploration and production (E&P) company was focused on remaining…

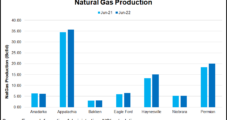

Lower 48 Output on the Upswing as Natural Gas to Grow in June, EIA Projects

The Energy Information Administration (EIA) is modeling sizable natural gas production increases from several major plays next month, including the Appalachian Basin and the Haynesville Shale. Total natural gas production from seven key onshore regions is set to climb 750 MMcf/d from May to June, reaching 91.750 Bcf/d, the agency said in its latest Drilling…

Anadarko-Focused E&P Rebrands to Canvas from Chaparral

Independent Chaparral Energy Inc. has been rebranded as Canvas Energy Inc., still privately held and still based in Oklahoma City. “Our new brand represents a renewed sense of purpose, enthusiasm and commitment to our employees, stakeholders, vendors and local communities to name a few,” said Canvas CEO Chuck Duginski. The company held about 231,000 net…

Acquisition-Minded Diversified Energy Looks to Optimize Lower 48 Natural Gas Well Inventory

Over the past two decades, Diversified Energy Co. has grown into a $1.3 billion company that operates 69,000 natural gas wells across the Lower 48, which produce about 106,000 boe/d on average. In fact, the Birmingham, AL-based and London Stock Exchange-listed firm claims it is the largest U.S. gas well operator. “Natural gas will be…

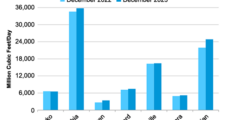

Lower 48 Plays to Continue Ratcheting Up Natural Gas, Oil Output in December, EIA Says

Led by growth out of the Haynesville Shale, natural gas production from seven key U.S. onshore regions is set to climb from November to December, according to updated projections from the Energy Information Administration (EIA). Total natural gas production from the Anadarko, Appalachia and Permian basins, as well as from the Bakken, Eagle Ford, Haynesville…

Devon Holding Lower 48 Natural Gas, Oil Production Flat into 2022

Global oil and natural gas demand is forecast to remain tight in the months ahead, but Devon Energy Corp. is holding the line on its Lower 48 production and instead rewarding shareholders. The Oklahoma City-based independent, whose portfolio is concentrated in some of the richest oil and natural gas basins of the country, plans to…