Statoil ASA, which has natural gas and oil operations in the Gulf of Mexico and across North America, last Thursday began delivering its U.S. natural gas produced in the Marcellus Shale to Canada to secure better prices.

America

Articles from America

Statoil Looking to Canada for Better Natural Gas Prices

Statoil ASA, which has natural gas and oil operations in the Gulf of Mexico and across North America, on Thursday plans to begin delivering its U.S. natural gas produced in the Marcellus Shale to Canada to secure better prices.

Industry Brief

Linde North America has upgraded its carbon dioxide (CO2) plants in Corpus Christi, TX, and Woodward, OK, to better serve the Midcontinent and Eagle Ford Shale regions with expanded CO2 availability. “Linde has brought these plants on stream to supply the surging demand for CO2 in the oil and gas industry,” said Lauren Porambo, CO2 product manager. “The use of CO2 in fracturing completions displaces the use of water, reduces formational damage and enhances well production.” CO2 is injected in a liquid state and converts to a gaseous state down-hole, mitigating formational damage and fluid on formation, while enhancing well clean-up and flow-back, Linde said. Conventional liquid pumps are used, so service companies require no specialized equipment.

Barclays Lifts 4Q Natural Gas Price

Barclays Capital has lifted its natural gas price forecast for the final three months of this year to $3.35/MMBtu, up from $3.00. Bank of America Merrill Lynch (BofA) last week also raised its 2013 gas price forecast.

U.S. Chemicals Industry Getting Shale Makeover

The shale natural gas market in North America is helping to revamp the U.S. chemicals industry and may benefit a variety of other manufacturing sectors through lower costs for raw materials and energy, according to a report issued last week by PwC US.

PwC: Shale Gas Transforming U.S. Chemicals Industry

The shale natural gas market in North America is helping to revamp the U.S. chemicals industry and may benefit a variety of other manufacturing sectors through lower costs for raw materials and energy, according to a report issued on Tuesday by PwC US.

BofA Nudges 2013 Natural Gas Price Forecast Up 25 Cents

With natural gas stocks at levels below the seasonal norm after a summer of market rebalancing, analysts at Bank of America Merrill Lynch (BofA) Monday lifted their 2013 average gas price forecast by 25 cents to $3.75/MMBtu.

Marcellus Is Biggest Fish in a 1.1 Qcfe U.S. Shale Gas Pond

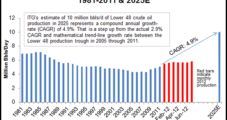

Lower 48 onshore oil and gas reserves are a huge energy pond, about 1.1 Qcfe worth, and the Marcellus Shale is its biggest fish. According to new research from Calgary-based ITG Investment Research, “the Marcellus dwarfs any other resource at 330 Tcfe, followed by the Eagle Ford and Bakken [shales] at 152 Tcfe (25 billion boe) and 72 Tcfe (12 billion boe), respectively.

North American Oilfield Services Activity Languishing

The North America oilfield services market “eroded more than we thought” in 3Q2012, and the spending decline may not turn around before next year, according to the research team at Tudor, Pickering, Holt & Co. (TPH).

INGAA Priorities: Cybersecurity, Gas-Electricity Coordination

Outgoing Interstate Natural Gas Association of America (INGAA) Chairman Greg Ebel and the pipeline group’s members “worked tirelessly” to ensure that legislation signed into law by President Obama earlier this year would “truly take pipeline safety and integrity management to a higher level,” according to incoming Chairman Greg Harper.