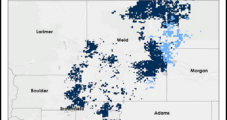

Denver-based Civitas Resources Inc., the largest oil and natural gas producer in the Denver-Julesburg (DJ) Basin, has added another trophy to its portfolio by snapping up Bison Oil & Gas II LLC in a cash-and-stock swap worth an estimated $346 million. Once the transaction is completed, now expected by the end of March, the takeover…

Tag / Acquisition

SubscribeAcquisition

Articles from Acquisition

EnCap-Backed Clearfork Gains Entry into Haynesville with Azure Acquisition

Fort Worth, TX-based Clearfork Midstream LLC said Tuesday it plans to acquire Azure Midstream Energy LLC, giving it entry into the core areas of the Haynesville Shale in North Louisiana and East Texas. The price was not disclosed for the takeover, which was funded by Clearfork sponsor EnCap Flatrock Midstream LLC (EFM). The private equity…

Harvest Midstream Expanding Eagle Ford Oil Services with Arrowhead Acquisition

Harvest Midstream is poised to take full ownership of some South Texas crude oil transportation and logistics assets as it seeks to expand services for upstream and downstream customers in the Eagle Ford Shale. The privately held midstream company announced a purchase and sale agreement to acquire the remaining 75% stake in Arrowhead ST Holdings…

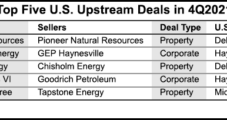

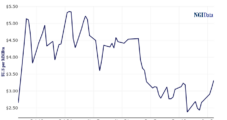

U.S. Upstream Dealmaking Fueled by Permian, Haynesville

The Permian Basin and natural gas-rich Haynesville Shale accounted for nearly all of the upstream transactions in the final three months of 2021, but dealmaking overall was down sharply from the third quarter, Enverus reported. The value of Lower 48 merger and acquisition (M&A) activity between exploration and production (E&P) companies totaled $9 billion in…

Repsol Acquires Marcellus Assets in Rockdale Bankruptcy

Repsol SA is bolting on acreage in the Marcellus Shale after successfully bidding for 43,000 net acres in Northeast Pennsylvania in a bankruptcy auction. The Spanish energy company has agreed to pay $222 million, including $2 million in debt, for Rockdale Marcellus LLC’s assets in Tioga, Lycoming and Bradford counties, according to court documents. The…

Southwestern Adds Natural Gas Heft in Haynesville-Bossier with GEP Takeover Completed

Southwestern Energy Co. has completed its takeover of GEP Haynesville, fortifying the Houston independent’s natural gas portfolio. The company in November agreed to pay $1.85 billion for GEP, the third-largest private explorer in the Haynesville and Middle Bossier formations. The transaction boosts Southwestern’s Haynesville scale by 700 MMcf/d, giving it total estimated output of 4.7…

Xfuels to Acquire Oil, Gas Wells in Kansas and Oklahoma

Alberta-based Xfuels Inc. reported Monday that it plans to expand into the United States by adding 516 Midcontinent oil and gas wells to its holdings. The new assets come via a letter of intent (LOI) to purchase 100% of the common stock of Jubilee Exploration LLC, which controls the wells across 10 counties in northeastern…

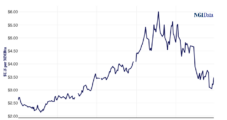

Goodrich Going Private in $480M Deal as Haynesville — and Natural Gas Prices — Heat Up

Publicly listed independent Goodrich Petroleum Corp. has agreed to be taken private by Paloma Partners VI Holdings LLC in a deal valued at roughly $480 million. Paloma, an affiliate of EnCap Energy Capital Fund XI LP, plans to launch a tender offer to acquire for $23/share in cash all of Goodrich’s outstanding common stock. Goodrich…

Sino American, Estacado Considering Texas Oilfield Venture

Sino American Oil Co. reported Tuesday that it plans to acquire a majority stake in a North Texas oil field. The Wyoming-based company said that it would obtain a majority working interest in the Piave Oil Field, located in Throckmorton County, TX, by way of a newly signed memorandum of understanding (MOU) with Estacado Energy…

Jera Acquires Additional Interest in Freeport LNG for $2.5B

Japan’s largest power producer, Jera Co. Inc., is acquiring a 25.7% stake in the Freeport liquefied natural gas (LNG) export terminal in Texas for $2.5 billion as it looks to secure more of the super-chilled fuel amid skyrocketing prices and to help meet climate targets. Investment firm Global Infrastructure Partners (GIP), which acquired the stake…