Denver-based U.S. Energy Corp. (USEG) has entered into a memorandum of understanding with APEG I Partners to acquire all of APEG’s interest in 67 Bakken Shale wells in McKenzie and Williams counties, ND. The proposed deal includes about 1.1 million boe of proved developed reserves (79% oil) and 400 boe/d of current production across 1,600 net acres. Total consideration is $17.8 million, consisting of a combination of cash, stock and assuming APEG’s outstanding commodity derivatives. USEG said it also plans to establish an $8 million revolving credit facility. The deal is contingent upon regulatory and shareholder approval.

Acquired

Articles from Acquired

Diamondback Strikes $1.2B Deal with Ajax to Build Permian West Texas Leasehold

West Texas stalwart Diamondback Energy Inc. has struck a deal to buy Permian Basin acreage in the Midland sub-basin from Ajax Resources LLC for $900 million and 2.58 million shares worth an estimated $345 million.

Continental Brings in Partner to Offset STACK/SCOOP Expenses

Toronto-based Franco-Nevada agreed Monday to pay $220 million for a stake in a newly formed Continental Resources Inc. subsidiary that would acquire minerals in the Oklahoma City-based independent’s holdings in the SCOOP and STACK, aka the South Central Oklahoma Oil Province and the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

California Resources Buys Remaining Elk Hills Stakes

California Resources Corp. (CRC) on Monday purchased the remaining interest in the historic Elk Hills oilfield in the San Joaquin Basin from Chevron Corp. for $460 million and 2.85 million common shares, giving it full ownership.

ArcLight Creating Appalachia-Focused E&P with ECA Purchase

ArcLight Capital Partners LLC said Thursday it has acquired privately held Energy Corporation of America (ECA) and a trove of natural gas assets in the Appalachian Basin to form an exploration and production (E&P) company. The purchase price was not disclosed.

Anticipating Growth, UGI Buys NatGas Gathering System in Pennsylvania

UGI Energy Services LLC has acquired a 60-mile-plus natural gas gathering system that spans three counties of Pennsylvania in the Marcellus Shale northern tier from upstart Rockdale Marcellus LLC for an undisclosed amount.

Tellurian’s New Haynesville Assets Bringing Supply Closer to LNG Export Project

Houston-based Tellurian Inc. last week veered into the upstream sector, making a deal to buy gassy Haynesville Shale acreage near its planned natural gas export facility in Louisiana.

Briefs — Rubicon Oilfield

Warburg Pincus-backed Rubicon Oilfield International Holdings LP, based in Houston, has snapped up Calgary-based World Oil Tools Inc. for an undisclosed amount to expand its downhole completions business. World Oil, established in 2000, makes specialty inflatable products and technology used in completions, and it works in North America’s unconventional basins, overseas and offshore. The deal would add inflatable packers, external casing packers and drill-stem testing technology to Rubicon’s portfolio. Formed in 2015, Rubicon designs, manufactures and sells/rents downhole oilfield products in more than 50 countries. Since its formation it has acquired other downhole products businesses including Tercel Oilfield Products, Top-Co Holdings and Logan International.

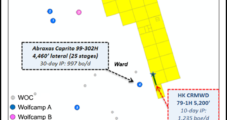

After Successful Test Well, Halcon Options More Permian Delaware Acreage

Halcon Resources Corp. said it will exercise an option to acquire more than 6,000 net acres in West Texas within the Permian Basin’s Delaware sub-basin and drill at least two wells in the near future, after determining that its first operated well in the play was a success.

Australia’s Sundance Adds Eagle Ford Acreage

Sundance Energy Australia Ltd. acquired additional working interests in 23 gross (1.5 net) producing wells and 1,449 gross (130 net) acres in the Eagle Ford Shale in McMullen County, TX, for $7.1 million.