Warren Resources Inc. plans to drill 25 new coalbed methane (CBM) wells in the Spyglass Hill Unit in Wyoming’s Washakie Basin, a sub-basin of the Greater Green River Basin, the New York City-based exploration and production company said.

About

Articles from About

$2B in Tax Revenue Expected from Shale-Driven Chemical Projects

Nearly 100 shale gas-driven chemical industry projects in the United States — worth about $71.7 billion — will generate $20 billion in federal, state and local tax revenue by 2020, according to an analysis released Monday by the American Chemistry Council.

Producers, Environmentalists Alike Lament Draft Fracking Rule

Oil and natural gas producers still are poring over the 171-page draft rule governing hydraulic fracturing (fracking) activities on public lands, and while proponents and opponents agree that some concessions were made by the agency in the latest rule to avoid duplication of state and tribal fracking requirements, they say BLM could have gone further.

Chevron Planning Regional Headquarters in Pittsburgh Area

Chevron Corp. said it has reached agreements to acquire two adjoining parcels of land totaling 61 acres in Moon Township in the Pittsburgh metropolitan area as a potential site for its regional headquarters office campus.

TransCanada Seeks Recovery for Aging Gas Pipes

TransCanada Corp. is seeking about C$3 billion in pipeline toll hikes to ensure that shippers cover costs of its aging natural gas Mainline from cradle to grave.

Tolls Are Just the Beginning of TransCanada’s NEB Appeal

TransCanada Corp. is seeking about C$3 billion in pipeline toll hikes to ensure that shippers cover costs of its aging natural gas Mainline from cradle to grave.

Texas Regulator Name Change, Reforms Still Pending

With about a month to go in the regular legislative session, Texas lawmakers are again inching their way toward changing up the Railroad Commission of Texas (RRC), including its name, or maybe not.

Industry Briefs

A news media tour was held Saturday at the Mayflower, AR, oil spill area under the joint command of local, state and federal officials, as well as ExxonMobil representatives. The event was held to provide an update of the spill, which occurred March 29 when a portion of the ExxonMobil Pegasus Pipeline ruptured. Since then, the portion of the 850-mile oil pipeline that failed has been removed for analysis at an independent laboratory and a new section of pipeline installed, all under state and federal oversight. In ExxonMobil’s most recent daily report the company indicated that cleanup was coming to an end and remediation of the area should begin soon. Monitoring by the company and various agencies has indicated that there has been no contamination of water or air from the spilling of what is estimated to be 5,000 bbl of oil. Besides U.S. Environmental Protection Agency representatives, there have been representatives from the federal Pipeline and Hazardous Materials Safety Administration, the Arkansas Attorney General’s Office and local government on the scene since the cleanup began. Arkansas Attorney General Dustin McDaniel launched an investigation several days after the incident (see Shale Daily, April 3).

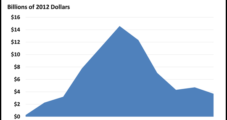

North America Again Tops Global Energy M&A

Oil and natural gas mergers and acquisitions (M&A) “slowed dramatically” in the first three months of this year from 2012, with activity slipping about 40% from the full-year 2012 average and inventory down by almost one-third, according to PLS Inc. However, as it has been for a few years, North America continued to draw the most interest and the most dollars, pulling in close to two-thirds of the transactions by dollar value and almost 80% of the total deals.

North America M&A Leads Global Markets in First Quarter

Oil and natural gas mergers and acquisitions (M&A) “slowed dramatically” in the first three months of this year from 2012, with activity slipping about 40% from the full-year 2012 average and inventory down by almost one-third, according to PLS Inc. However, as it has been for a few years, North America continued to draw the most interest and the most dollars, pulling in close to two-thirds of the transactions by dollar value and almost 80% of the total deals.