The U.S. Bureau of Land Management (BLM) received bonus oil and natural gas bids totaling $4.068 million for 26 parcels in Utah that cover 37,414 acres in the latest quarterly lease sale, officials reported Tuesday.

2005

Articles from 2005

Enterprise COO: Ethane Margins Anemic, Volatile

Enterprise Products Partners LP infrastructure bounced back from Hurricane Katrina in 2005 and a fire at Mont Belvieu, TX, in 2011, and the partnership will weather the current “tsunami of natural gas liquids (NGL)” that is ravaging margins in the light end of the NGL barrel, Enterprise COO Jim Teague told financial analysts last Thursday.

Enterprise’s Teague: Ethane Margins to Be Anemic, Volatile

Enterprise Products Partners LP infrastructure bounced back from Hurricane Katrina in 2005 and a fire at Mont Belvieu, TX, in 2011, and the partnership will weather the current “tsunami of natural gas liquids (NGL)” that is ravaging margins in the light end of the NGL barrel, Enterprise COO Jim Teague told financial analysts Thursday.

Shale Gas Needs Infrastructure Investment, KKR Exec Says

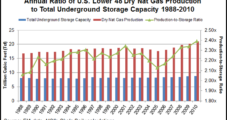

Tapping all of the potential in U.S. shale natural gas isn’t a given; it requires changes to, and investment in, basic energy infrastructure, including an expansion of the U.S. pipeline and storage network, according to KKR & Co. LP.

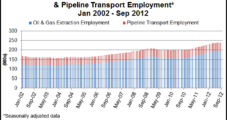

Unconventionals Are a Huge U.S. Job Creator, Says IHS

The U.S. energy outlook is “fundamentally changed” because of the revolution in unconventional natural gas and oil production, generating strong job creation, economic growth and government revenues, IHS Inc. said Tuesday.

New York DEC Chief: Frack Study Health Experts Not Contracted

A panel of outside experts that will help conduct a health impact analysis of high-volume hydraulic fracturing (HVHF) in New York are not yet under contract, Department of Environmental Conservation (DEC) Commissioner Joseph Martens said Friday.

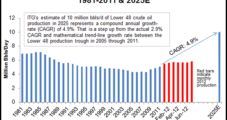

Marcellus Is Biggest Fish in a 1.1 Qcfe U.S. Shale Gas Pond

Lower 48 onshore oil and gas reserves are a huge energy pond, about 1.1 Qcfe worth, and the Marcellus Shale is its biggest fish. According to new research from Calgary-based ITG Investment Research, “the Marcellus dwarfs any other resource at 330 Tcfe, followed by the Eagle Ford and Bakken [shales] at 152 Tcfe (25 billion boe) and 72 Tcfe (12 billion boe), respectively.

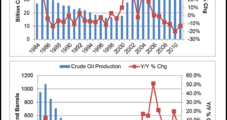

Shale Gas: An Opportunity Wrapped in a Dilemma

Low prices have made dry gas from shales a producers’ problem and an end-user’s dream. But interests at both ends of the market do agree that the right gas price — the equilibrium price — would make shale gas a boon for the country.

Chesapeake Caves to Shareholders; Utica Acreage For Sale

Ahead of the annual shareholder meeting on Friday, Chesapeake Energy Corp. acquiesced to demands of major shareholder groups and Carl Icahn, who now holds 7.8% of the stock, and said four existing independent directors would resign from the board. The company also has put up for sale 337,481 net acres in its prized Utica/Point Pleasant Shale, which would give it less than one million acres in the play.

Alberta Government’s Budget Floating on Shale

A rush for liquids-rich natural gas and tight oil embedded in dense rock formations, using shale drilling methods imported from the United States, is bailing the Alberta government out of sinking deeply into the red.