Sustained Heat Enough to Lift Weekly Natural Gas Prices Again Despite Hurricane Laura’s Ravaging

In what may be the last blast of summer, near triple-digit temperatures across Texas and much of the Southeast this week boosted weekly spot gas prices for the Aug. 24-28 period. However, with the former Hurricane Laura crashing ashore the Gulf Coast late in the period, and temperatures falling on the West Coast, NGI’s Weekly Spot Gas National Avg. slipped 1.5 cents to $2.240.

Once a Category 4 storm packing 150 mph winds, Laura had degenerated to a tropical depression by Thursday afternoon and was losing tropical characteristics by early Friday, according to the National Hurricane Center. However, the monster storm caused widespread power outages and flooding as it made landfall, taking a direct hit at the Cameron liquefied natural gas (LNG) export terminal and narrowly missing the Sabine Pass export facility by about a mile.

Both export facilities had shut down and evacuated personnel ahead of Laura’s landfall and on Friday, Cameron LNG’s response team was on site assessing Laura’s impact on the plant, according to spokesperson Anya McInnis. The work is ongoing and would continue over the next few days.

“Our focus is to secure the site, address any safety hazards and assess the integrity of the facility. When the assessment is complete, we can progress a timeline of activities to restart operations,” she said.

All Cameron employees are safe, and the company was working to provide recovery assistance for those impacted personally by the storm.

Despite the one-two punch to demand, from both power outages — estimated to be north of 830,000 at the height of the storm — and shuttered operations at the two export terminals that wiped out more than 2 Bcf/d, prices throughout Texas, Louisiana and the Southeast were stronger week/week.

For the week, benchmark Henry Hub jumped 15.5 cents to average $2.500, and Houston Ship Channel climbed 10.0 cents to $2.460.

Over in the Southeast, Transco Zone 5 shot up 18.5 cents week/week to $2.570.

Gulf of Mexico operators on Friday also were inspecting their platforms and rigs to determine when they could safely begin restarts and deploying staff.

Royal Dutch Shell plc, one of the largest producers in the deepwater, said eight of its nine operated assets were shut-in. The ninth asset, the Perdido in the southwestern GOM, was not shut-in and remained fully operational.

BP plc, on Friday was preparing to inspect its four operated facilities in the deepwater “for any potential damage resulting from hurricanes Marco and Laura.” Production was to remain shut-in, said a spokesperson, “until we have confirmation that our platforms are able to operate safely, pipeline companies have confirmed the operability of offshore pipelines and the shore-based transportation and receiving systems are working as necessary.”

Weather permitting, overflights for facilities were to begin Friday, but BP indicated it wasn’t possible to predict how long the process would take.

Back onshore, the brief bout of heat during the week supported prices. Chicago Citygate tacked on 12.5 cents to hit $2.315, and some Appalachia prices were up more than 25 cents week/week. Gains in the Northeast were mostly small, but points along the Transcontinental Gas Pipe Line rallied much more strongly.

Out West, SoCal Citygate averaged $4.335 for the week, off $2.705, and similar losses extended into the Desert Southwest.

Futures Still Strong

Though it ended on a soft note, it was another solid week for gas futures prices. The September Nymex contract shot up about 12 cents when it rolled off the board Thursday, settling at $2.579. October, even after sliding about 5 cents on its first day at the front of the curve, settled just above $2.65.

Given where production sits, and the expectation for LNG to bounce back and rise moving into the fall season, the bullish case for winter remains quite evident, even at the current price level of $3.17, according to Bespoke Weather Services.

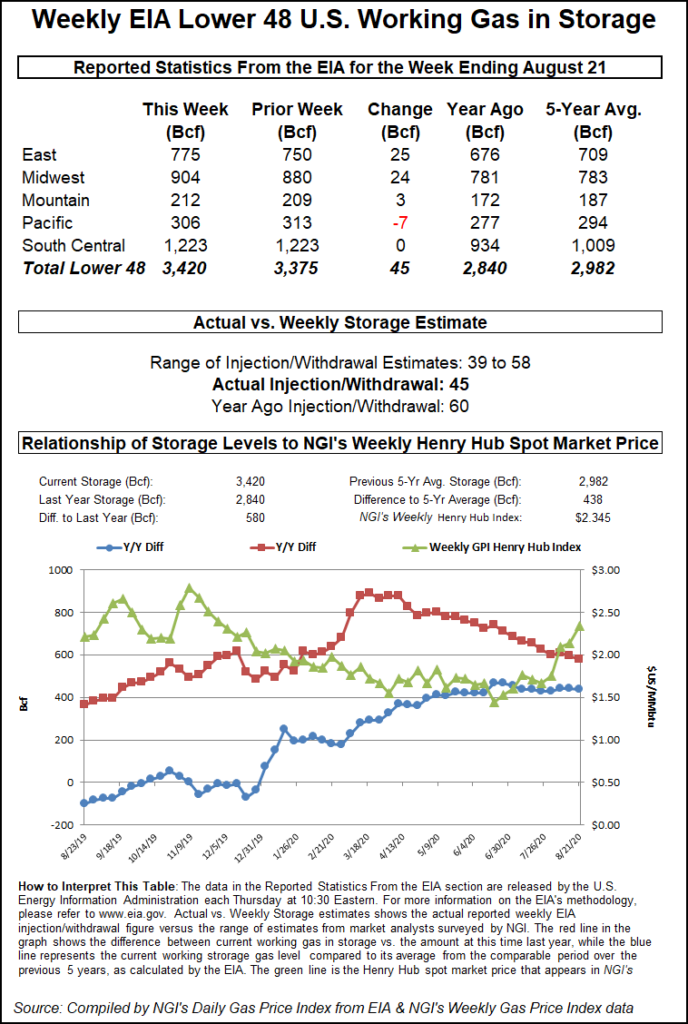

However, the firm continues to see potential issues at the front of the curve, given how high storage is at this point in the injection season. On Thursday, the Energy Information Administration (EIA) said that total stocks rose by another 45 Bcf to 3,420 Bcf, which is still a hefty surplus to both year-ago and five-year averages.

Strong power burns over the second half of the summer reduced injections and for some analysts, containment concerns had abated. However, Bespoke said there are some bearish risks with the coming weather pattern, which is looking cooler into the eight- to 15-day time frame.

“This is notable because September has been very warm over the last few years, so any deviation from the hotter theme could disrupt comps to the last few years,” the forecaster said. “Also, the move even higher in terms of prices places us at risk for some additional loosening of supply/demand balances.”

Bespoke said the market appears to be looking past all of this, but said it is worth being “very cautious” at the front of the curve. “Anything going wrong places the front in some jeopardy given that we are at record high storage levels in some regions.”

The recent strength in winter prices could hold firm, however, as the bearish risks are focused more at the front of the curve. This means that spreads attached to October could widen somewhat over the next few weeks, “despite conventional wisdom favoring more narrowing. Any delay in getting LNG back online would increase this risk.”

Weaker Cash

With demand set to ease beginning over the weekend, spot gas prices across most of the country fell on Friday. Losses were led by the Northeast, where what’s left of Laura was expected to bring heavy showers to the region, with additional weather systems moving through in the coming days.

Transco Zone 6 NY cash on Friday was down 53.0 cents to $1.090, while farther upstream, Dominion South fell 16.0 cents to $1.040.

Southeast prices for gas delivered through Monday also dropped by the double digits at several hubs, but Transco Zone 4 slipped only 4.5 cents to $2.500.

Henry Hub also lost 4.5 cents to average $2.460, while prices farther west continued to post substantial declines. El Paso S. Mainline/N. Baja plunged 56.5 cents to $3.230, and SoCal Citygate fell 17.5 cents to $3.865.

In the Permian Basin, Waha gas for delivery through Monday jumped 41.0 cents to $1.465, a move that was in line with other hubs in the region.

Cash prices across the border in Western Canada retreated a bit, with NOVA/AECO C slipping 5.0 cents to $2.575.

TPH reported that AECO storage inventories, which entered the injection season at a 28% deficit to the five-year average, are now on pace to hit capacity at the end of September. The refill has been supported by 2Q2020/3Q2020 basis of roughly 35 cents/Mcf, which is inside transport costs of 70-90 cents, depending on the pipeline. “This has incentivized gas to remain in basin rather than be exported,” said analysts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |