Regulatory | Coronavirus | E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Survival of U.S. Oil, Gas Sectors Said at Risk from Coronavirus, Withering WTI Prices

The U.S. oil and gas industry is taking a severe pounding because of the oil price rout and the coronavirus pandemic, responding in turn by downsizing activity, spending and workforces, but analysts are warning uncertainty remains about whether it’s enough.

The exploration and production (E&P) sector, along with the midstream and oifield services sectors, are reducing capital expenditures (capex), laying down rigs and cutting dividends, with some executive teams voluntarily reducing their salaries through the rest of the year.

Oklahoma City-based Continental Resources Inc., one of the biggest Midcontinent operators, is cutting capex by 55%. Parsley Energy Inc., which already has announced cuts to spending, said the executive team has joined others in agreeing to take a 50% cut in their take-home pay through the rest of the year.

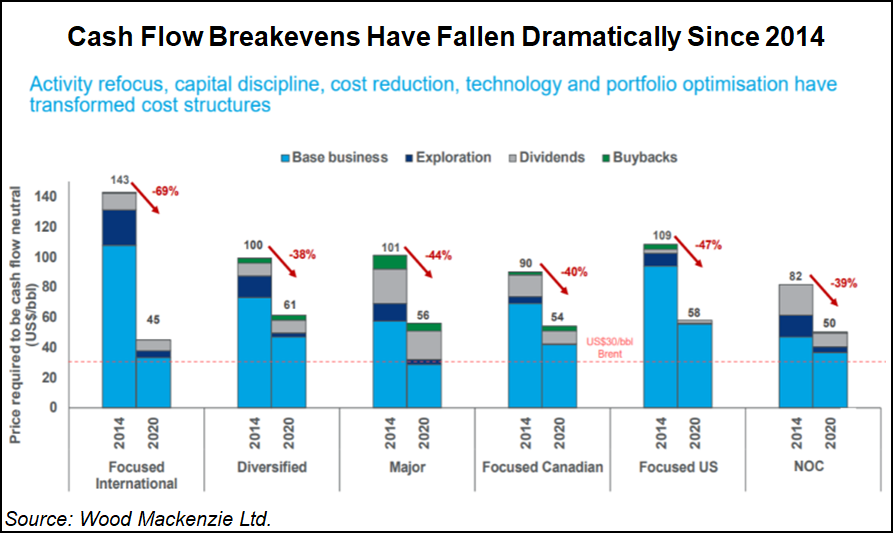

West Texas Intermediate (WTI) front month oil prices jumped by double-digits early Thursday but a return to breakeven prices remains uncertain. Because of efficiencies that were required during the 2014/2015 oil price rout, corporate financials are in better shape, but the room to maneuver is limited, according to Wood Mackenzie.

“This crisis is very different from those that the sector has seen before,” researchers said Thursday. “Debt and equity markets are all but closed for the U.S. independents, in contrast to the previous oil price collapse.” Upstream merger and acquisition liquidity “is also limited. Survival will rely on swift and deep cuts to investment.”

Through last Friday, more than one-third of the companies covered by Wood Mackenzie in its Corporate Service have cut capex by 30%. However, more work may be needed if low oil prices linger.

“Deep spending cuts across the board are needed to achieve cash-flow neutrality at $35/bbl in 2020,” said Wood Mackenzie’s Roy Martin of the corporate analysis team. “We calculate an average spending cut of 57% will be required for our coverage if only upstream spend is targeted.

“A reduction of 41% would be needed across all spend categories, including dividends, to be cash flow neutral at $35/bbl.”

Apache Corp. and Occidental Petroleum Corp., among others, have sharply reduced dividends to free up capital, according to Wood Mackenzie.

“We expect more companies to follow suit,” Martin said. “The majors will use their balance sheets to support current dividends. We believe buybacks will be suspended and some will re-introduce scrip dividends to preserve cash.”

More “radical action may be needed if current low prices persist,” he said. “Balancing the books at $30/bbl in 2020 is possible for many companies. But tough decisions would be required.”

U.S. crude production is at risk because a large portion of volumes are in the hands of distressed E&Ps, according to Tudor, Pickering, Holt & Co. (TPH).

“Elevated leverage profiles, seized up capital markets, and tightening bank lending standards will have a notable impact on U.S. production growth moving forward, especially with WTI now under $25/bbl,” the TPH team said.

In their updated at-risk production analysis, TPH analysts estimate 2.3 million b/d of supply is held by distressed producers, “which accounts for a notable 22% of total onshore U.S. production.”

Not all of the distressed E&Ps are expected to go into decline, but “we’re likely to see meaningful output decline…in 2020-21.” In TPH’s update in December covering a group of 50 E&Ps, the biggest contributors at risk were listed as California Resources Corp., Chesapeake Energy Corp., Oasis Petroleum Corp. and Whiting Petroleum Corp.

TPH has now added Callon Petroleum Co., Continental Resources, Extraction Oil & Gas Inc., Ovintiv Inc., PDC Energy Inc., QEP Resources Inc. and SM Energy Co.

Permian Basin heavyweight Parsley, based in Austin, TX, last week reduced capex by more than 40%. Now the executive team has agreed to reduce annual cash compensation by half from 2019.

“This is not a time for indecision or half measures,” said Parsley CEO Matt Gallagher. “Our work is far from done and our team will continue to be adaptive and responsive in these challenging times.”

Midcontinent producer Continental Resources cut 2020 capex by 55% to $1.2 billion, and it is forecasting it will be cash flow neutral with WTI at about $30/bbl. The company also has cut the average rig count in the Bakken Shale to three from nine, and the rig count has been reduced to four from 10.5 in Oklahoma.

Executive Chairman Harold Hamm said the “budget adjustment” was “precipitated by the collapse of crude oil prices due to the market manipulation of Saudi Arabia and Russia…We believe this is a short-demand cycle, which could see some near-term correction when this illegal dumping practice is halted.”

Midstream operator Targa Resources Corp. has cut capex by 32% to $800-900 million. It also has sharply reduced the dividend to 10 cents from 91 cents.

“In this uncertain environment, where we are dealing with the combination of significantly lower commodity prices and lower expected activity levels given recent producer actions, compounded by the evolving impacts of the coronavirus pandemic, we believe that the prudent decision for Targa is to move swiftly in utilizing levers available to us to strengthen our balance sheet,” CEO Matthew J. Meloy said.

NGL Energy Partners LP also is revamping fiscal 2021 capex plans. Beginning April 1, growth capex is set at $50 million. The partnership also is exiting its gas blending business by the end of this month to reduce debt. “We are responding quickly in anticipation of an environment that could get increasingly challenging in calendar 2021,” CEO Mike Krimbell said.

Meanwhile, Royal Dutch Shell plc on Wednesday temporarily suspended construction in Western Pennsylvania at the 1.6 million metric ton/year ethane cracker in Western Pennsylvania because of the coronavirus. Shell and its partners earlier this week cut the workforce at a liquefied natural gas (LNG) export project underway in British Columbia, LNG Canada.

The Pennsylvania cracker, with an estimated 8,000-person crew, is being constructed on a 400-acre site adjacent to the Ohio River in Beaver County, about 30 miles northwest of Pittsburgh.

“The health and well being of our workers and nearby communities remains Shell’s top priority,” said Shell Pennsylvania Chemicals Vice President Hillary Mercer. Shell will be directed by what the Centers for Disease Control and Prevention (CDC) recommends. “In the days ahead we will install additional mitigation measures aligned with CDC guidance. Once complete, we will consider a phased ramp-up that allows for the continuation of safe, responsible construction activities.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |