Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Surging U.S. Oil, Gas Dealmaking in 3Q2018 to Continue, Says DrillingInfo

U.S. oil and natural gas dealmaking during the third quarter surged 250% from the second quarter, breaking records that date back to the final three months of 2012, according to Drillinginfo.

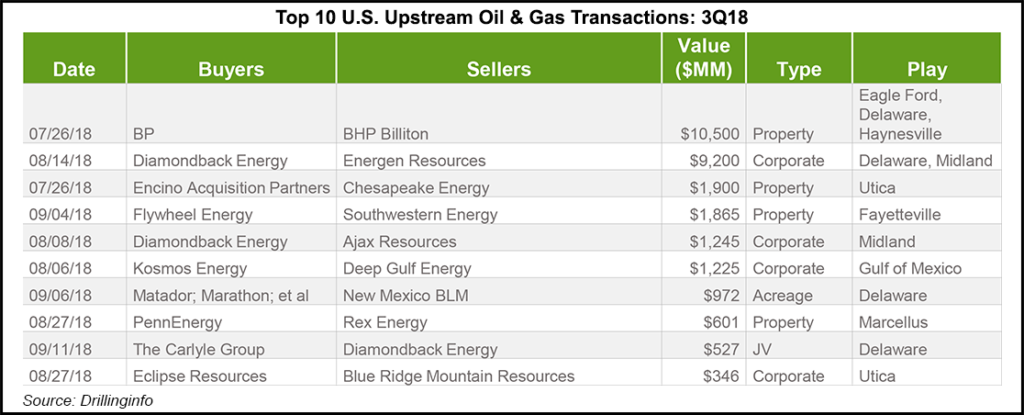

Third quarter merger and acquisition (M&A) activity totaled $32 billion, versus $9.1 billion in 2Q2018. The 3Q2018 activity is 76% above the quarterly average of $18.3 billion, which dates back to 2009 and the highest quarter since 4Q2012’s $37.8 billion.

Drillinginfo completed the Oil and Gas M&A Review and Outlook with its research and database firms PLS Inc. and 1Derrick.

Property transactions led the way in 3Q2018, with upstream deals totaling $17.8 billion, trumping corporate, acreage, royalty and joint venture/farm-out deals.

“We expect U.S. M&A activity to continue at a heightened level,” said Drillinginfo senior director Brian Lidsky. “The industry is regularly reporting record well results across the U.S. shales as it continues to de-risk acreage positions and advance technology.”

Drillinginfo had predicted in July that a dramatic climb in dealmaking was anticipated, as oil prices were rising and “motivated sellers” were ready to make transactions.

“As Wall Street is increasingly discriminating among public companies, the food chain of the big getting bigger is alive and well” and “shale basin leaders are being rewarded for mastering scale, efficiency and technology,” Lidsky said. “This sets the stage for additional mergers that not only checks all the accretive boxes for the buyer, but also provides sellers upside by joining forces with these leaders.”

The biggest dealmaker in 3Q2018 was by BP plc, which agreed to pay $10.5 billion for nearly all of BHP’s U.S. onshore portfolio. The transaction adds heft to BP’s Lower 48 portfolio with acreage in the Permian Basin, Eagle Ford and Haynesville shales.

The purchase marked “BP’s return to offense with its largest upstream buy since buying Arco for $28 billion in April 1999,” DrillingInfo noted. BP reportedly beat out Royal Dutch Shell plc for the asset package, “a dynamic that solidifies the importance of the U.S. shales as a key portfolio element for global majors.”

Also during the third quarter, Permian-focused Diamondback Energy Inc. acquired Permian peer Energen Corp. for $9.2 billion, just shy of the Permian record set early this year when Concho Resources Inc. agreed to pay $9.5 billion for RSP Permian Inc.

“We view the recent Concho and Diamondback examples in the Permian as the start of a trend — not one-off style hits,” Lidsky said. “Shale basin consolidation will be a continuing theme supplemented by occasional major new entrants for those few large and global companies who have not yet established a significant shale presence.

“Private equity and private companies will continue to play a role in deploying carefully calculated risk dollars to fringe areas and benches within established resource plays plus advancing today’s technology to new areas like the Powder River Basin as well providing inventory as they move to divest mode.”

Researchers said the “show me the cash” mood of Wall Street remained intact, which favors larger operators that have visibility to free cash and substantial Tier 1 acreage. The Permian-focused buying spree in 3Q2018 came in conjunction with a Bureau of Land Management (BLM) auction early in September in the New Mexico portion of the Permian Delaware sub-basin. The auction broke BLM sales records at $972 million, with record high bids reaching more than $95,000/acre.

“While active, the M&A market remains largely in the buyer’s camp,” as there were motivated sellers that failed to receive minimum acceptable bids for their onshore assets, including SandRidge Energy Inc., which attempted a corporate sale, and Whiting Energy Inc.’s planned Niobrara asset sale in Colorado.

According to the report, global energy transactions in 3Q2018 totaled $156 billion, versus $161 billion in 2Q2018. The global transactions were spread across the value chain to include deals in upstream, midstream, downstream oilfield services, power, utilities and liquefied natural gas (LNG).

Researchers expect to see a “continued high pace” in M&A activity over the next six to 12 months, with an estimated $30 billion of U.S. deals for sale offering a big inventory for activity.

Consolidation among onshore players is “likely to increase in momentum as scale and efficiency rewards larger players.” Private capital also should lead in derisking “fringe” areas of known plays to re-emerging areas that include the Powder River Basin.

For the natural gas sector, analysts said transactions generally may be restricted to “de-risked and economically viable development, assuming $3.00/gas with proximity to growing Gulf Coast LNG and petrochemical demand playing a factor.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |