Despite global uncertainty over a potential economic recession, global aluminum supply will continue to be under pressure by high demand through this year, according to executives at top U.S. producer Alcoa Corp.

“European smelters and more recently one smelter in North America have cut capacity due to higher energy prices,” CEO Roy Harvey said on a conference call detailing second quarter earnings. “On the demand side, while there is some global uncertainty in the near term, demand continues to grow.”

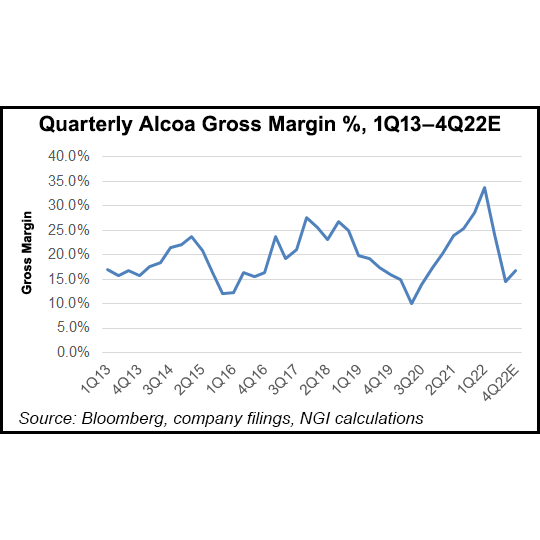

He added that, “Given the price and cost pressures over the past quarter, we also see significant amounts of global alumina and aluminum capacities that are likely to be cash negative based on an analysis through June, which means global operating capacities will remain...